The foreign exchange (forex) market is a global financial marketplace where currencies are traded, providing participants with opportunities to buy, sell, exchange, and speculate on various currency pairs. Forex trading Malaysia has experienced significant growth and development over the years, reflecting the country’s dynamic economy and its increasing participation in international trade and investment. This overview will delve into the landscape of the forex market in Malaysia, discussing its regulatory framework, market participants, trading hours, and the factors influencing its performance.

Regulatory Framework

The forex market in Malaysia operates under the oversight of two key regulatory bodies: the Securities Commission of Malaysia (SCM) and the central bank, Bank Negara Malaysia (BNM). These institutions collaborate to ensure the forex market’s integrity and stability while implementing stringent regulations to safeguard traders and maintain transparency.

Forex brokers operating within Malaysia are subject to comprehensive rules, including capital adequacy requirements and risk management standards. Additionally, brokers are required to segregate client funds to protect traders’ assets. Leverage limits have been introduced to mitigate risk, particularly for retail traders, enhancing the overall security and reliability of the market.

Market Participants

The forex market in Malaysia features a diverse array of participants, including retail traders, institutional investors, forex brokers, and central and commercial banks. Retail traders constitute a significant portion, enjoying easy access to online trading platforms with relatively low capital requirements. Institutional investors, such as hedge funds and asset management companies, engage in forex trading for portfolio diversification and risk management.

Forex brokers play a pivotal role as intermediaries, providing traders with access to the market, trading platforms, and essential services. Additionally, central banks, particularly Bank Negara Malaysia, actively participate to manage foreign exchange reserves and stabilize currency values, while commercial banks facilitate forex transactions for individuals and businesses.

Currency Pairs and Trading Instruments

The forex market in Malaysia offers a wide range of currency pairs for trading, including popular majors like EUR/USD, USD/JPY, and GBP/USD. Traders also have access to derivative instruments such as futures, options, and contracts for difference (CFDs). These diverse instruments cater to traders’ varying preferences and strategies, enabling them to participate flexibly in the forex market.

Trading Hours

Forex trading in Malaysia is not confined to traditional trading hours. Instead, it operates 24 hours a day, five days a week, reflecting its global nature. Key trading sessions include the Asian, European, and North American sessions. For traders in Malaysia, the Asian session is particularly relevant due to the time zone alignment. Furthermore, overlapping trading hours between different sessions often witness heightened market volatility and liquidity, making them favorable for active traders.

Technology and Platforms

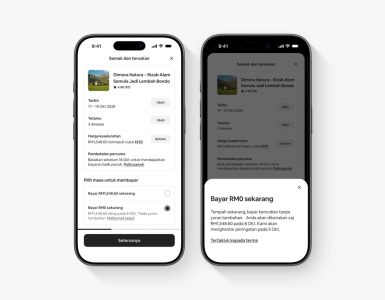

The advent of technology has significantly transformed forex trading in Malaysia. Online trading platforms, notably MetaTrader 4 and MetaTrader 5, have become ubiquitous, offering traders advanced charting tools, real-time data feeds, and automated trading capabilities. These platforms have empowered traders with accessibility, convenience, and advanced features.

Additionally, mobile trading apps have gained popularity, enabling traders to execute trades and monitor the market on their smartphones and tablets. Automation and algorithmic trading systems, including expert advisors (EAs), are on the rise, reducing emotional biases and enhancing trading efficiency.

Market Trends and Volumes

Over the years, the forex market in Malaysia has experienced substantial growth in terms of both participants and trading volumes. This growth is attributed to increased awareness and accessibility to forex markets.

Recent trends include a shift toward sustainable and socially responsible investing, as well as a focus on comprehensive trader education and support services provided by brokers. Liquidity in the Malaysian Ringgit (MYR) can vary depending on economic conditions and global market sentiment, with major currency pairs typically enjoying higher liquidity.

Factors Influencing the Forex Market in Malaysia

Several factors influence the forex market in Malaysia. Economic indicators, such as GDP growth, inflation rates, and trade balances, hold significant sway over currency values. Both domestically and globally, political stability and geopolitical developments can impact exchange rates, with Malaysia’s relations with neighboring countries and major global powers being of particular interest to forex traders.

Decisions by Bank Negara Malaysia regarding interest rates and monetary policy directly influence the value of the Malaysian Ringgit (MYR) and the broader forex market dynamics. External trade factors, including Malaysia’s trade relations and export-import dynamics, also contribute to currency fluctuations, especially for those engaged in international trade.

Challenges and Risks

Forex trading in Malaysia presents certain challenges and risks that traders must navigate. Exchange rate volatility is inherent to the forex market and can result in sudden and unpredictable price movements. Regulatory risks, including changes in forex regulations and compliance requirements, can impact trading conditions and strategies. Traders also need to remain vigilant against scams and fraudulent schemes that can occur in the forex market, emphasizing the importance of due diligence and risk management.

Benefits of Forex Trading in Malaysia

Forex trading in Malaysia offers several advantages. It enables portfolio diversification beyond traditional asset classes like stocks and bonds. The accessibility of online trading platforms and the flexibility of trading hours allow traders to participate at their convenience. Moreover, forex trading provides the potential for profit in both rising and falling markets, making it an attractive option for speculative trading and capitalizing on market trends.

Conclusion and Outlook

The forex market in Malaysia is poised to continue evolving. Advancements in technology and regulations improvements will likely contribute to a robust and competitive trading environment. As such, traders and investors should stay informed about market developments and adhere to regulatory guidelines to ensure a successful and secure forex trading experience in Malaysia.