GXBank, the digital banking sensation, has officially launched its GX Card, extending a range of benefits and cashback perks to its first batch of users in Malaysia.

In a recent announcement on its Facebook account, GXBank shared the exciting news with its customers, stating, “Great news! We’re starting to roll out our debit card to Malaysians one batch at a time as we continue to improve and refine the experience. If you don’t spot the card within your GX app yet, hang tight, we’ll be serving it up to you soon!”

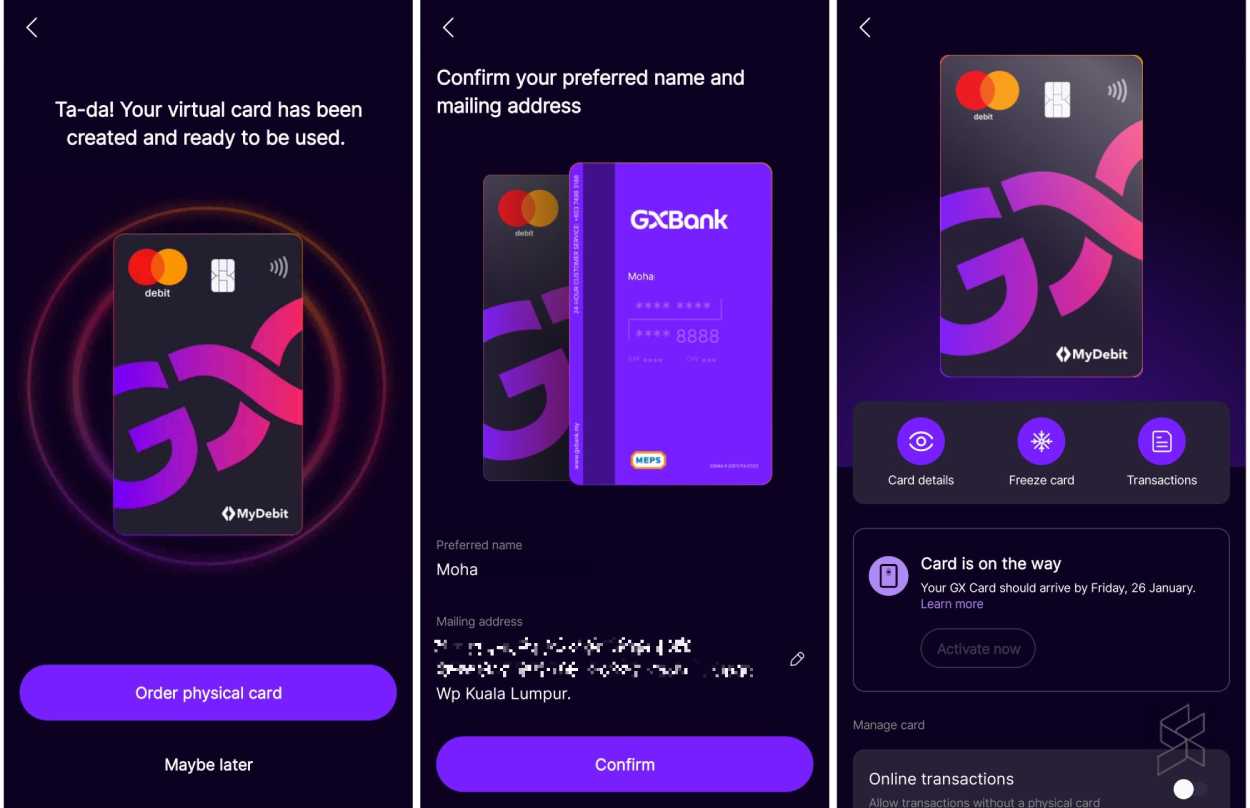

The GX Card, a debit card powered by Mastercard, is currently offered for free during its phased rollout. Users in the first batch will find a “Get your GX Card” option on the home screen of the GXBank app, making sign-up a breeze. The digital bank emphasizes a quick and easy process, allowing users to customize their card with a preferred name of up to 25 characters.

For a limited time until December 31, 2024, GXBank has waived the RM12 fee for physical card issuance, along with other charges such as the MEPS withdrawal fee and admin fee for foreign transactions. The virtual GX Card is issued immediately upon application, providing users with access to online shopping and in-app payments.

For physical transactions, users can request a contactless-enabled physical GX Card at no extra cost during this promotional period, and it comes with a 5-year validity upon issuance. The app enables users to manage various aspects of their GX Card, including spending limits, online transaction preferences, and ATM withdrawals.

Exclusive Cashback Offers

One of the key highlights of the GX Debit Card is its unlimited 1% cashback for every spending. The cashback applies to various transactions, including bill payments, groceries, petrol, dining, and shopping. However, e-wallet top-ups, insurance payments, and government- and charity-related transactions are excluded from this offer. The GXBank debit card also boasts no markups or hidden fees for overseas transactions, making it an ideal companion for international travel.

GXBank has partnered with Jaya Grocer, offering users an additional 1% cashback benefit when using the physical GXBank debit card, along with earning 1.5x GrabRewards Points for every RM1 spent, a perk for GrabUnlimited subscribers.

For those not yet GXBank customers, an ongoing sign-up campaign offers attractive cashback incentives until February 29, 2024. New users can earn RM8 cashback upon opening a GX account, depositing a minimum of RM88, and an additional RM8 cashback by linking their DuitNow ID with their GX account. Additionally, linking a GX account with a Grab account provides users with up to RM29.40 cashback on their GrabUnlimited subscription.

As GXBank continues to revolutionize digital banking in Malaysia, users can expect more innovative offerings and features in the near future. Interested individuals can sign up for GXBank by downloading the GXBank app via the Apple App Store and Google Play Store.