This year, Malaysian food and insurance brands emerge as clear winners, ahead of retail brands (brand value at USD815 million) as the eighth and tenth largest contributors in brand value respectively – according to a new report by Brand Finance, the world’s leading brand valuation consultancy.

With a combined brand value of USD1.6 billion, the 11 food brands ranked moved up from being the ninth to eighth largest contributor in 2024. Leading Malaysian food brands in our rankings with the largest brand value growth are Guan Chong (brand value up 48% to USD64 million) followed by Felda Global Ventures (brand value up 32% to USD433 million) and KLK (brand value up 30% to USD433 million).

Petronas retains Top Spot for 14th consecutive year

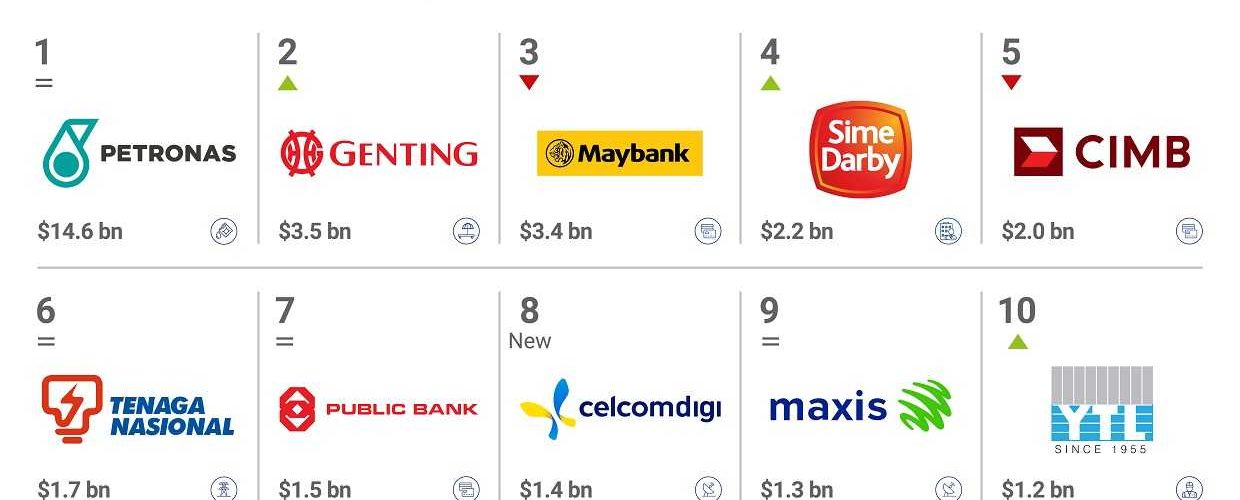

Meanwhile, PETRONAS (brand value up 15% to USD14.6 billion) has once more held on to the title of most valuable Malaysian brand in our rankings for the 14th year in a row. Following in second and third place respectively are Genting (brand value down 2% to USD3.5 billion) and Maybank (brand value down 14% to USD3.4 billion). Both were also in the top three spots in 2023, with Genting rising from the 3rd place and Maybank slipping down from the 2nd last year.

Climbing up eight places from last year, Dutch Lady Milk (brand value down 21% to USD199 million) clinched the title of the strongest Malaysian brand ranked among the nation’s most valuable brands in 2024. Achieving a brand strength rating of AAA compared to AAA- in 2023, the food brand also saw an increase in its BSI score by 8.1 points to 88.2 of 100. Occupying the subsequent second and third places are PETRONAS (brand value up 15% to USD14.6 billion) – last year’s strongest – and new entrant in our rankings, Mr D.I.Y (brand value at USD537 million).

Malaysia Airports and MISC lead in brand value growth

Malaysia Airports recorded the largest brand value growth of 53% to USD101 million among most valuable Malaysian brands listed this year while logistics brand MISC (brand value up 49% to USD511 million), comes behind with the second largest brand value growth followed by food brand Guan Chong (brand value up 48% to USD64 million) at the third placing. In terms of brand value rank, Malaysia Airports soared 14 places to rank as the 62nd most valuable brands ranked, while MISC moved up four places to 22nd and Guan Chong climbed up 10 places to 75th.

Alex Haigh, Managing Director of Brand Finance Asia Pacific commented “Despite global economic uncertainties, Malaysia’s food and insurance sectors are experiencing growth. This can be attributed, in part, to the government’s proactive measures in supporting domestic businesses.”

Haigh highlighted the successes of Guan Chong and Takaful IKHLAS, noting that their growth underscores the importance of a robust brand strategy aligned with Malaysia’s competitive advantages. “Their success stories reveal the importance of a well-defined brand strategy aligned with Malaysia’s competitive advantages. Guan Chong, a dominant force in food processing, has excelled by leveraging its brand strength and market leadership to capitalise on rising food prices. Similarly, Takaful IKHLAS’ strategic focus on Islamic financial products and its success in expanding its general takaful offerings have positioned them for significant growth within a thriving market.”

Role of sustainability in driving brand value

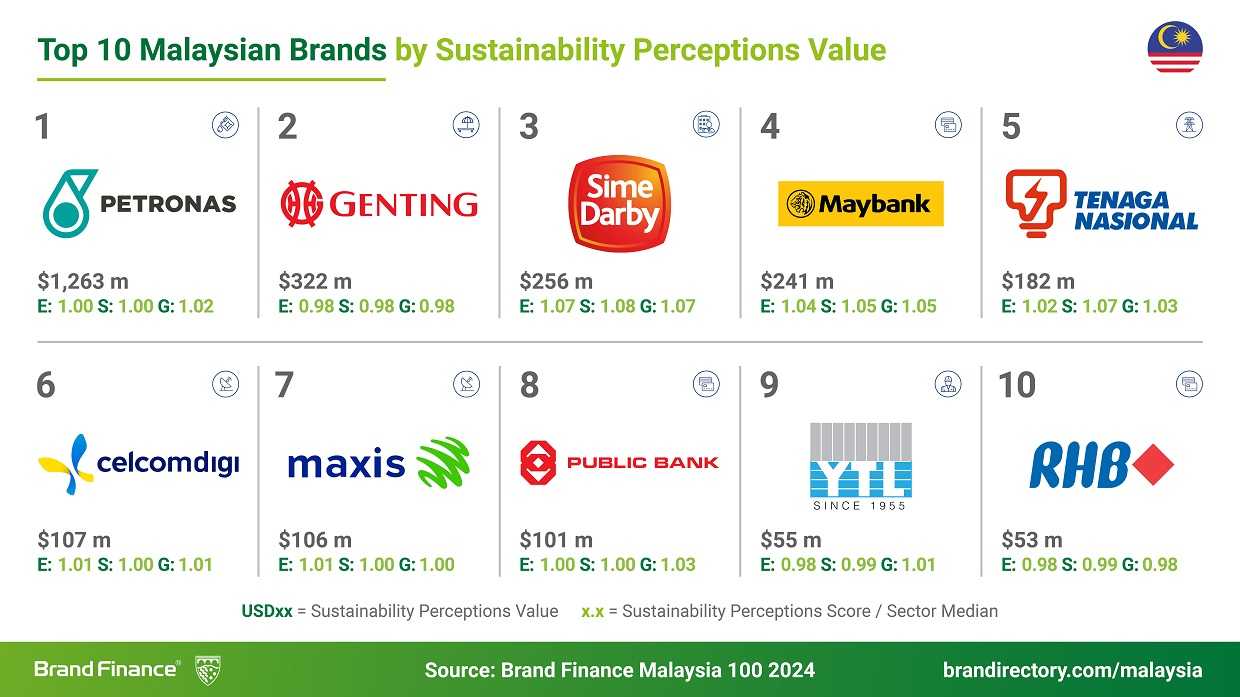

Brand Finance also utilises its Global Brand Equity Monitor (GBEM) research to compile a Sustainability Perceptions Index. The study determines the role of sustainability in driving brand consideration across sectors and offers insight into which brands global consumers believe to be most committed to sustainability.

For individual brands, the Index displays the proportion of brand value attributable to sustainability perceptions. This Sustainability Perceptions Value is the financial value contingent on a brand’s reputation for acting sustainably. From here, Brand Finance’s perceptual research is analysed alongside CSRHub’s environmental, social and governance (ESG) performance data to determine a brand’s ‘gap value’. This is the value at risk or to be gained, based on the difference between sustainability perceptions and actual performance.

The 2024 Sustainability Perceptions Index finds that among Malaysian brands, PETRONAS has the highest Sustainability Perceptions Value of USD1.3 billion. It also has the highest positive gap value of USD87 million among brands in the rankings. A positive gap value means that brand sustainability performance is stronger than perceived: brands can add value through enhanced communication about their sustainability efforts, so that perceptions are raised to fully account for the brand’s actual sustainability performance. Metro’s gap value suggests that it could generate an additional USD87 million in potential value through enhanced communication of its impact and accomplishments in sustainability.

Brand Finance’s annual evaluation encompasses 6,000 of the largest brands globally, publishing over 100 reports that rank brands across all sectors and countries. The Brand Finance Malaysia 100 2024 report includes the 100 most valuable and strongest Malaysian brands. The full ranking, along with additional insights, charts, detailed information about the methodology, and definitions of key terms, is available in the Brand Finance Malaysia 100 2024 report.