Agensi Kaunseling dan Pengurusan Kredit (AKPK) commenced its inaugural Financial Well-Being Conference today at Bank Negara Malaysia’s Sasana Kijang, Kuala Lumpur. The two-day event titled “Level Up! Your Mind, Your Body, and Your Money” has brought mainly HR practitioners, from agencies and corporations that have been collaborators of AKPK, to a course of presentations and discussions on topics of physical, mental and financial health.

Officiating the event was Deputy Health Minister, YB Dato Lukanisman Awang Sauni. In his keynote address, deputy minister highlighted on the significance of staff well-being to workplace productivity and emphasised that it goes beyond physical well-being. Mental wellness is a major determinant of employee productivity too, and a solid control over one’s finances contributes to a stable mental disposition.

Linking Financial Health to Productivity

This was in line with what was mentioned by AKPK’s CEO, Azaddin Ngah Tasir, in his welcoming remarks, “AKPK’s own research substantiates that money and mental well-being are inter-related. As much as 26% of Malaysian Working Adults suffer from varying degrees of financial stress, and 65% of these said that financial stress has affected their job performance. Imagine how much productivity we can secure if we could bring that 26% down to a much lower percentage.”

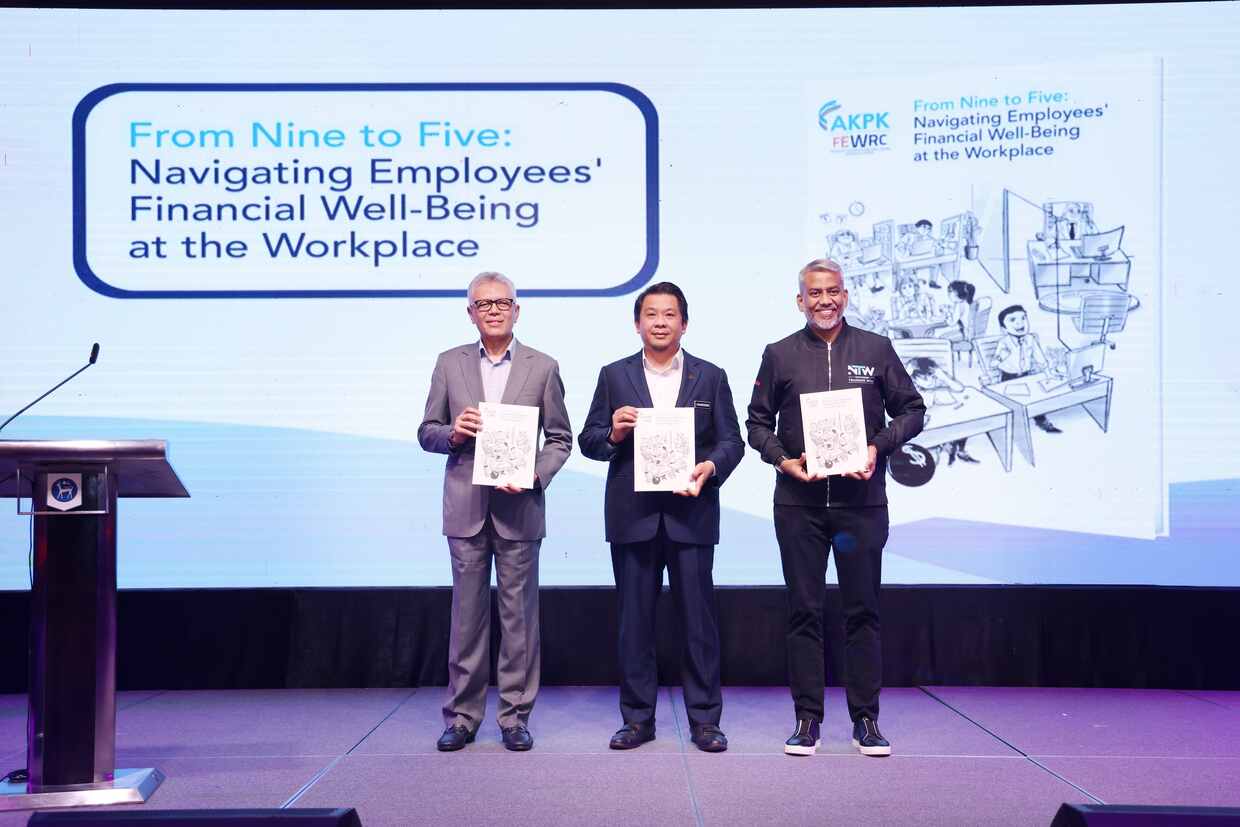

Azaddin was referring to a report produced by AKPK’s own Financial Education Well-being Research Centre (FEWRC) titled ‘From Nine to Five: Navigating Employees’ Financial Well-Being at the Workplace’. The research report was launched by the deputy minister during the event.

On average, based on the FEWRC report, 70% of Malaysian Working Adults (MWAs) with the lowest financial well-being were low-performing employees. Whereas, 78% of those with the highest financial well-being exceeded productivity expectations. These figures highlight the critical role of financial education in enhancing workplace productivity.

Azaddin added, “As a person’s financial well-being improves, so does employee loyalty, creating a more stable and committed workforce. Our finding reveals that 91% of MWAs with high financial well-being were loyal to their companies, while 89% of those with poor financial well-being were actively seeking new job opportunities. Money cannot buy loyalty, but financial well-being will, as the two are connected. And, by financial well-being, we mean the knowledge and skill to manage any available resources, such as money and financing, to one’s advantage.”

Bridging the Gap in Financial Education

As much as this is important, however, the research report indicates a gap between the supply and demand for financial education training. While 74% of Malaysian working adults considered attending financial courses, only 48% of the companies surveyed, hosted such programmes for their employees.

Hence, the launching of this FEWRC report at the conference is deemed to be apt. Azaddin recommends the integration of employees’ financial well-being as a key agenda into any organisation’s plan for increased productivity.

Datuk Wira Shahul Dawood, CEO of HRD Corp was among the top industry captains and practitioners who shared their invaluable insights into health, finances, careers, and transformation. Public personalities present to carry out the agenda of the event included Datuk Shalin Zulkifli, Kevin Zahri, and Douglas Lim.

The conference ended with a special video presentation featuring the CEO of AKPK under the boroughs of giant trees in a forest, telling the story of AKPK’s journey and its unwavering commitment to fostering financial resilience among Malaysians.