In the ever-evolving world of forex trading, staying ahead requires continuous learning and adaptation. One of the most effective tools for achieving this is the use of a trading demo account. For advanced traders in Malaysia, demo accounts provide an invaluable resource for honing skills, testing new strategies, and maximizing learning potential without the risk of financial loss.

The importance of demo accounts for advanced traders

Demo accounts are often perceived as tools for beginners, but they are equally crucial for advanced traders. Here’s why:

- Risk-Free Environment: A demo account allows traders to experiment with new techniques and strategies without the fear of losing real money.

- Platform Familiarization: Even seasoned traders need to stay updated with the latest trading platforms and tools. A demo account provides a sandbox environment to explore these features.

- Strategy Testing: Advanced trading strategies can be complex and require thorough testing. Demo accounts offer a perfect testing ground to refine these strategies.

- Market Simulation: Demo accounts simulate real market conditions, enabling traders to experience market volatility, trends, and other dynamics without financial risk.

Leveraging demo accounts for advanced techniques

To fully utilize the benefits of demo accounts, advanced traders in Malaysia should focus on the following strategies:

- Backtesting Strategies:

- Historical Data Analysis: Use the demo account to apply strategies to past market data to evaluate their effectiveness.

- Optimization: Refine your trading strategies based on backtesting results to improve performance.

- Algorithmic Trading:

- Develop and Test Algorithms: Create trading algorithms and test them in a demo environment to ensure they perform as expected.

- Automation Familiarization: Get accustomed to automated trading and its nuances without risking real capital.

- Technical Analysis Practice:

- Charting Tools: Utilize advanced charting tools available in demo accounts to practice technical analysis.

- Indicator Testing: Experiment with different technical indicators to determine which combinations yield the best results.

Practical tips for using demo accounts effectively

Maximizing the potential of demo accounts requires a disciplined approach. Here are some practical tips:

- Treat it Like a Real Account: To gain the most from a demo account, treat it with the same seriousness as a real trading account.

- Set Realistic Goals: Establish clear, achievable goals for your demo trading activities.

- Track Performance: Maintain a trading journal to document your strategies, trades, and outcomes. Analyze this data to identify areas for improvement.

- Gradual Transition: Once you’re confident in your strategies, gradually transition from the demo account to a real account. Start with smaller trades to build confidence.

Overcoming common challenges with demo accounts

While demo accounts offer numerous benefits, advanced traders in Malaysia may face certain challenges when using them. Understanding and addressing these challenges can further enhance the effectiveness of demo trading.

- Psychological Differences:

- Lack of Emotional Investment: Trading with virtual money may not evoke the same emotional responses as real trading. To counter this, maintain the same level of discipline and seriousness.

- Overconfidence: Success in a demo account might lead to overconfidence. Always remember that real trading involves real risks.

- Market Differences:

- Order Execution: Demo accounts may not always perfectly replicate real market conditions, especially regarding order execution. Be aware of these differences and adjust expectations accordingly.

- Slippage and Spreads: Real accounts often experience slippage and varying spreads that demo accounts might not accurately reflect. Factor these into your strategy testing.

- Transitioning to Real Trading:

- Gradual Integration: Instead of switching to a real account abruptly, gradually integrate real trading by starting with small positions.

- Continued Learning: Continue using the demo account alongside your real account to test new strategies and keep refining your approach.

Advanced trading techniques to master with demo accounts

To truly maximize the learning potential of demo accounts, advanced traders in Malaysia should focus on mastering the following techniques:

- Scalping:

- Definition: Scalping involves making numerous small trades to capitalize on minor price movements.

- Practice: Use the demo account to perfect timing, quick decision-making, and executing trades at high speeds.

- Swing Trading:

- Definition: Swing trading aims to capture short- to medium-term gains over a few days to weeks.

- Practice: Develop and test strategies that identify potential market swings using technical and fundamental analysis.

- Position Trading:

- Definition: Position trading involves holding trades for longer periods, from weeks to months, based on long-term trends.

- Practice: Use the demo account to analyze long-term charts and test strategies based on macroeconomic factors and trend analysis.

- Risk Management:

- Stop-Loss and Take-Profit: Perfect the use of stop-loss and take-profit orders to manage risk effectively.

- Position Sizing: Practice calculating and adjusting position sizes based on risk tolerance and market conditions.

The role of technology in enhancing demo account experience

Advanced traders in Malaysia can leverage technology to enhance their demo account experience further. Here’s how:

- AI and Machine Learning:

- Predictive Analytics: Use AI-driven tools to analyze market data and predict potential movements.

- Strategy Development: Implement machine learning algorithms to develop and backtest complex trading strategies.

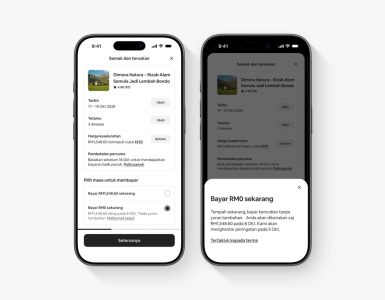

- Mobile Trading Apps:

- Convenience: Use mobile trading apps to access your demo account on the go, ensuring you can practice and test strategies anytime, anywhere.

- Real-Time Alerts: Set up real-time alerts and notifications to stay updated with market conditions and test your strategies promptly.

- Social Trading Platforms:

- Community Insights: Participate in social trading communities to gain insights from other advanced traders.

- Copy Trading: Experiment with copy trading in a demo environment to understand its dynamics and potential benefits.

Conclusion: The path to mastery

For advanced forex traders in Malaysia, a trading demo account is more than just a practice tool; it’s a crucial element in the journey to mastery. By systematically utilizing demo accounts to test and refine strategies, understand market dynamics, and overcome psychological challenges, traders can significantly enhance their skills and performance. Embrace the technology and resources available, and continuously strive for improvement. In the competitive world of forex trading, the edge gained through diligent practice and learning can make all the difference.