Managing finances effectively and securely is essential for online shopping, subscribing to digital services, and booking travel accommodations. A virtual card for shopping offers convenience, security, and flexibility, making it an ideal choice for international transactions.

A virtual card is a digital version of a traditional debit or credit card. It functions the same way, allowing online purchases and transactions. However, it exists only in digital form, reducing the risk of physical theft and loss. Virtual cards are issued by financial institutions and can be used for online shopping, app purchases, subscription payments, and media buying.

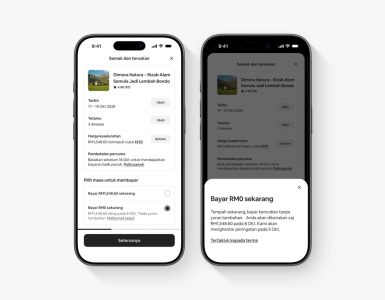

Choosing a global financial service for your transactions ensures broader acceptance and fewer issues with currency conversion. Virtual cards, especially those without spending and top-up limits, provide financial freedom. They allow payments for a wide range of services such as Netflix, Google Play, and AppStore, as well as hotel bookings and cruises. Using a dollar-based card is advantageous because most popular platforms accept payments in dollars.

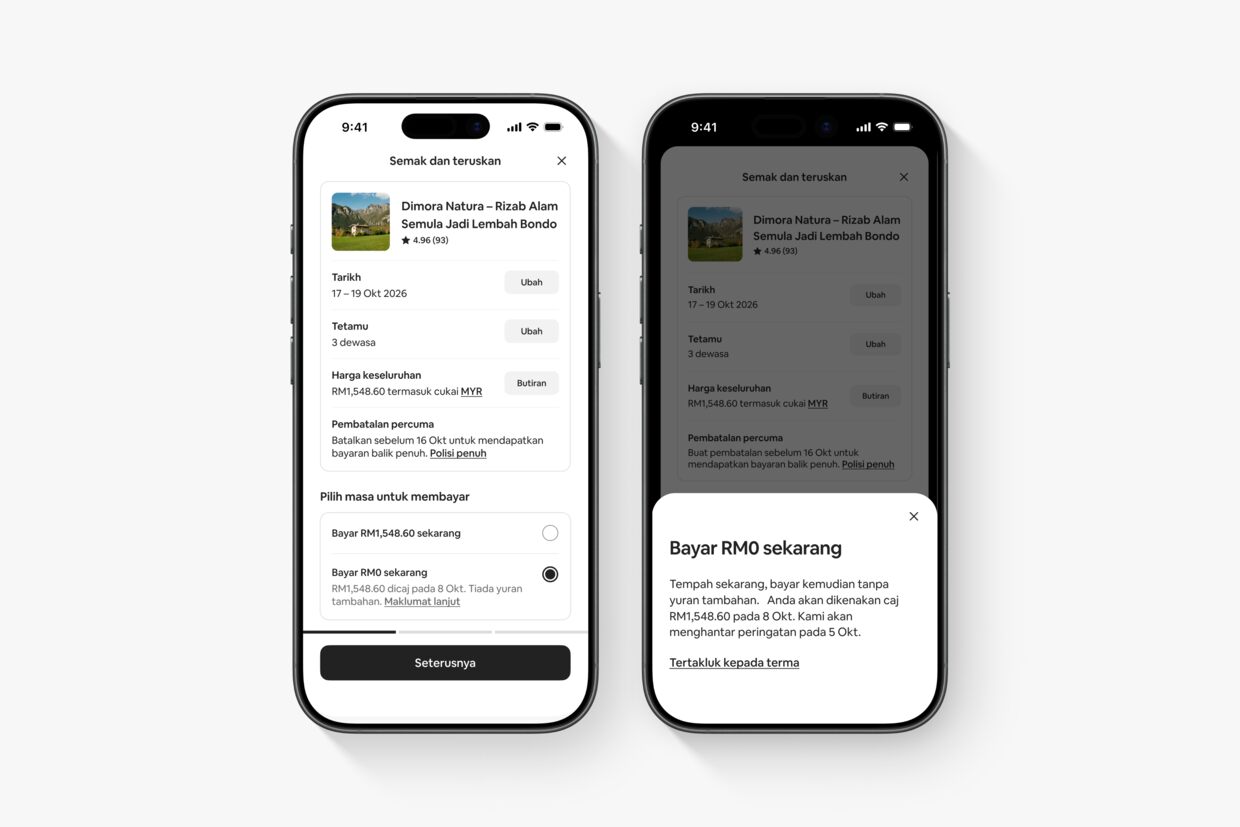

PSTNET: Selecting the right financial service

When selecting a financial service offering virtual cards, prioritize those without spending and top-up limits. This feature prevents restrictions on your financial activities. PSTNET is an innovative financial platform that provides digital Visa and Mastercard options for various needs. With PSTNET, you can shop online in international stores, make in-app purchases, pay for subscriptions and digital services, and engage in media buying. The platform supports multiple currencies and facilitates unlimited international purchases and transactions.

Security with 3D Secure Technology

Online payment security is critical. The 3D Secure technology enhances security by requiring a secret code for each transaction. This code is sent via SMS, your personal account, or a Telegram bot, ensuring that only authorized users can complete the transaction. This added layer of security is especially valuable for online shopping, where the risk of fraud is higher compared to traditional transactions.

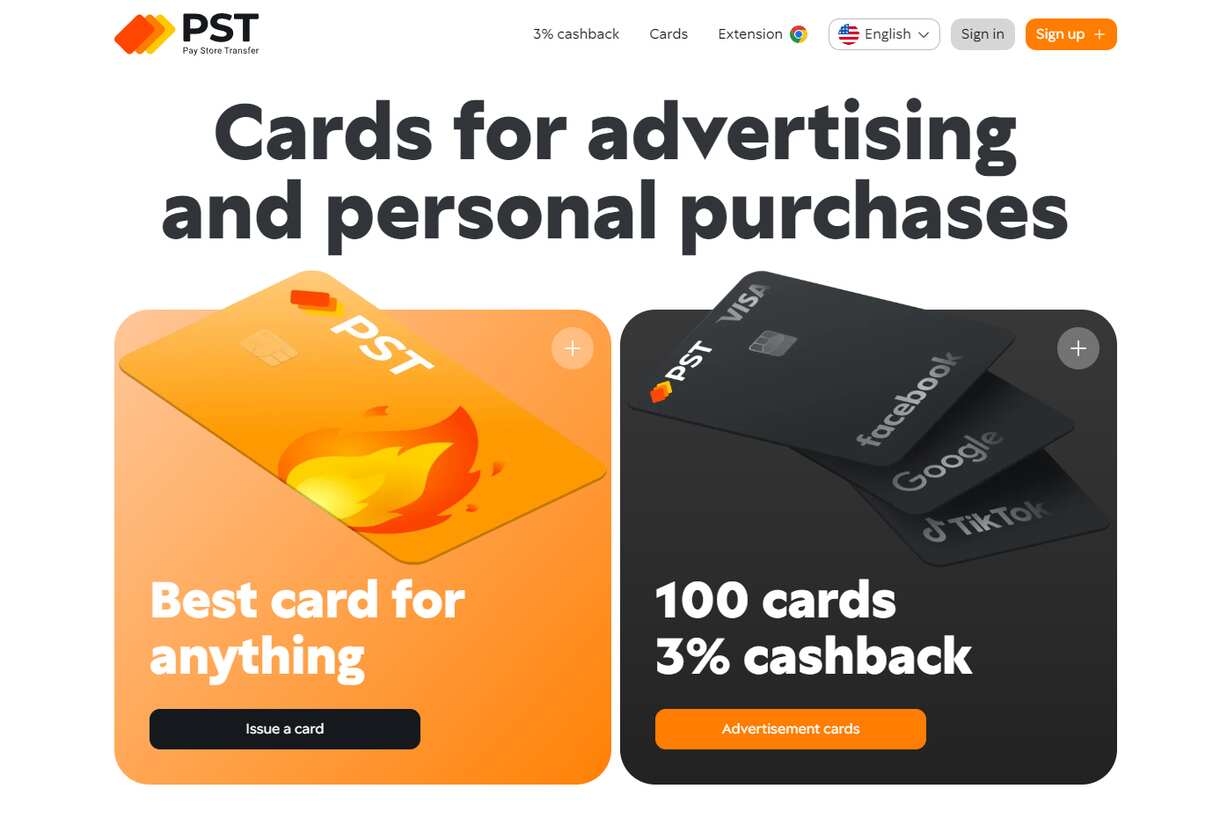

PSTNET: Ultima Virtual Card

PSTNET offers the Ultima 3D secure virtual card, which has no spending and top-up limits. It is well-suited for frequent purchases and payments for digital services. The key advantages of the Ultima card include no transaction fees, no charges for withdrawals or declined payments, and easy top-ups through various methods.

Features of PSTNET’s Ultima Virtual Card:

- Easy Top-ups: Funds can be added via popular cryptocurrencies (USDT TRC-20/BTC and 15 others), SEPA/SWIFT bank transfers, or Visa/Mastercard.

- Low Top-up Fees: The top-up fee is only 2%, regardless of the method used.

- Quick Registration: Sign up and get your first card in just two minutes using your Google, Telegram, Whatsapp, or Apple account.

- Instant Card Issuance: No documents are needed for the first card, which is available immediately after registration. Verification is required only if the top-up amount exceeds $500 or for mass card issuance.

- Free Cards: Cards become free with sufficient monthly expenses.

- Easy Withdrawals: Withdrawals incur no additional costs.

- Functional Telegram Bot: Notifications and 3DS codes are sent to the bot.

- 24/7 Customer Support: Support is available around the clock via Telegram, Whatsapp, and email.

To sum up, virtual cards simplify financial operations by providing security, flexibility, and ease of use. PSTNET’s Ultima virtual card is a robust option with no spending or top-up limits, making it an excellent choice for frequent online shoppers and digital service users.