Fiuu, Southeast Asia’s leading fintech platform, has carved a major milestone in the financial technology landscape, securing two prestigious entries in the Malaysia Book of Records. In 2024, the company achieved the Highest Payment Gateway Sales Value and Largest Payment Gateway Transactions in a single year, processing an impressive RM35.6 billion (USD7.9 billion) in transaction value and over 500 million online transactions.

These historic achievements mark Fiuu’s growing dominance and trust within the digital payments ecosystem, reflecting the company’s aggressive investment in building robust, scalable, and inclusive financial infrastructure across ASEAN.

A digital backbone for ASEAN’s cashless future

Fiuu’s expansion across eight Asian markets — Malaysia, Singapore, Thailand, Indonesia, Vietnam, the Philippines, Taiwan, and Hong Kong — underscores its pivotal role in driving the region’s transition toward cashless commerce. With over 70,000 merchants across diverse sectors such as retail, logistics, healthcare, and government, Fiuu’s wide-reaching network is a testament to its ability to cater to the varied needs of businesses and consumers alike.

CEO Eng Sheng Guan credited the company’s success to its long-term vision and strong technological foundation.

“This recognition affirms the trust and faith our partners, merchants, and institutions have placed in us. We are building the systems that support our region’s economy today while laying the foundation for future collective growth,” Eng said.

Fiuu’s platform seamlessly integrates over 110 payment methods, offering merchants both online and offline solutions through collaboration with major financial players like Visa and Mastercard.

Explosive growth driven by seamless transactions

In 2024 alone, Fiuu witnessed a remarkable 208% growth in Visa and Mastercard transactions, an achievement fueled by its easy merchant onboarding processes, lower merchant discount rates, and improved cross-border capabilities. The fintech company’s powerful architecture — certified under ISO 27001:2022 and PCI DSS — ensures secure, reliable transaction flows, analyzing over one million transactions daily using advanced AI-driven monitoring systems.

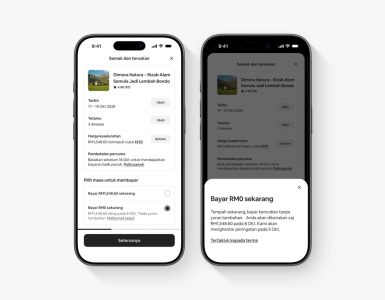

Fiuu’s commitment to consumer-centric innovation also shines through with features like Buy Now Pay Later (BNPL) and Visa Instalment solutions, offering flexible payment options that align with modern spending behaviors.

Security remains a key pillar of Fiuu’s strategy. Its state-of-the-art infrastructure leverages artificial intelligence to monitor transaction anomalies, detect fraud risks early, and provide real-time threat intelligence to protect merchants and consumers.

These proactive measures, combined with global compliance standards, have bolstered Fiuu’s reputation as a trusted fintech partner across the region.

“As the region moves toward an inherently connected future, Fiuu is poised to be the trusted digital layer businesses rely on,” Eng noted, signalling the company’s ambition to stay ahead of evolving market needs.

Future-ready with emerging technologies

Looking ahead, Fiuu plans to strengthen its leadership by investing in next-generation payment technologies. Upcoming innovations include greater support for tokenization, IoT-enabled payments, biometric authentication, and Apple Pay integration — each designed to meet the demands of a rapidly digitalizing society.

Furthermore, Fiuu’s continued emphasis on expanding AI-driven fraud prevention capabilities and broadening acquiring partnerships ensures that it remains resilient and adaptable in a dynamic global fintech environment.

As Fiuu builds on its record-setting momentum, its unwavering focus on innovation, security, and inclusivity positions it as a central force powering Southeast Asia’s financial future.

Add comment