Malaysian fintech pioneer MADCash Sdn. Bhd. has emerged as the grand prize winner at the prestigious 7th Ethical Finance Innovation Challenge and Awards (EFICA), held in Dubai on April 24. Organised by Abu Dhabi Islamic Bank (ADIB) in partnership with the London Stock Exchange Group, the EFICA Awards celebrate innovation in ethical and Islamic finance on the global stage.

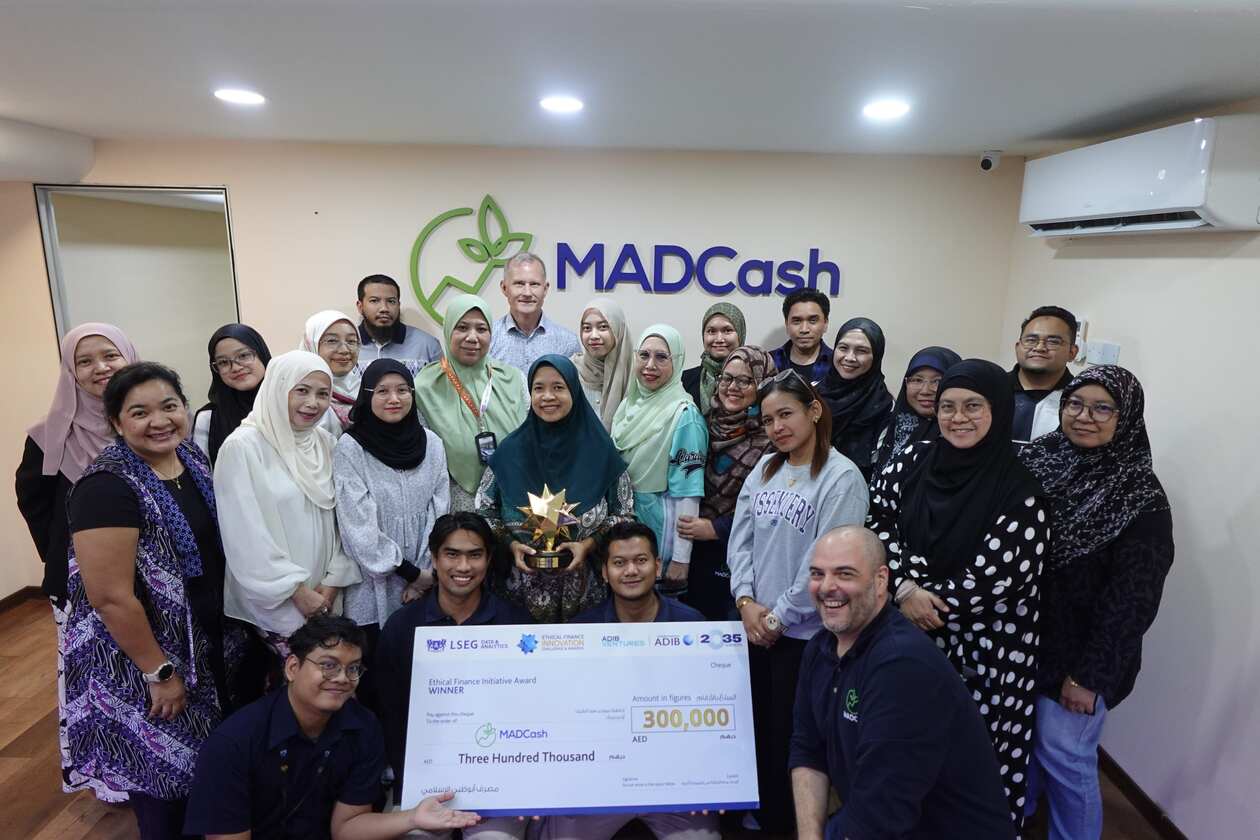

Selected from a pool of more than 150 global submissions, MADCash was voted the winner by a live audience during a gala dinner event after delivering a compelling presentation. The company walked away with a cash prize of AED 300,000 (approximately RM380,000), a commemorative trophy, and a spotlight in the international ethical finance community.

The accolade marks a significant milestone for the Kuala Lumpur-based company, which is best known for its zero-interest microloans designed to support women entrepreneurs excluded from the traditional financial system.

Empowering the underserved

Receiving the award on stage, MADCash Founder and CEO Nuraizah Shamsul Baharin expressed heartfelt gratitude and reaffirmed the company’s mission.

“Winning the EFICA Award is deeply meaningful for us. It greatly validates our unique business model of providing zero-interest microloans to underbanked and unbanked women micro-entrepreneurs,” she said.

“With this prize, we can work on adding AI tools to enhance our fintech platform to improve our funds tracking and borrower selection process, as well as raise funds to support more women entrepreneurs. We’re on a mission to empower one million women — and this brings us one step closer.”

MADCash, an acronym for Multiply, Assist, Donate Cash, is grounded in the principles of financial inclusion and Islamic finance. Its innovative approach combines microfinancing with financial literacy and digital tools, enabling women to start or grow small businesses without the burden of conventional debt.

Regional growth and strategic collaborations

Currently operating in Malaysia, Singapore, and Tajikistan, MADCash is setting its sights on regional expansion, with plans to launch in Thailand in the near future. Its scalable model and strong social impact have already attracted attention from major financial institutions.

MADCash has established successful collaborations with Maybank Islamic Berhad, Hong Leong Islamic Bank Berhad, PayNet, and AEON Bank. These partnerships are instrumental in driving the company’s mission forward and reinforcing its reputation as a socially responsible fintech enabler.

The recognition from EFICA is expected to amplify MADCash’s influence in the ethical finance space and encourage similar models across the region.

EFICA: Celebrating impact and integrity in finance

Now in its seventh edition, EFICA has become a cornerstone event in the global Islamic finance calendar. It aims to identify and reward initiatives that demonstrate strong ethical values, scalability, and adherence to Sharia-compliant principles.

MADCash stood out among three finalists, with the other two being UK-based Kestrl and Ethiopia’s Kifiya Financial Technology — both noted for their impactful ethical finance models. The EFICA advisory board, made up of leading voices in Islamic finance, played a key role in selecting the top contenders based on innovation and social impact.

The award ceremony in Dubai showcased how fintech solutions rooted in ethics and community upliftment are gaining traction in the global financial ecosystem. MADCash’s win underscores not only its visionary leadership but also Malaysia’s growing influence in socially conscious fintech.

MADCash’s EFICA triumph reflects broader progress in Malaysia’s fintech sector, particularly in the areas of Islamic finance and women’s economic empowerment. It also reinforces the country’s role as a global hub for ethical innovation in finance.

Add comment