Have you been surprised by your credit card statement at the end of the month after purchasing something from an international online store and there are no ways to save money?

Does it seem that the total charged to your credit card was not the same as the amount you saw during checkout?

Online shopping has become more prevalent in recent years because it enables us to purchase various items with just a few clicks from our electronic devices and the notion to save money becomes an illusion.

However, many Malaysians remain susceptible to hidden fees and unfair charges when making international purchases, travelling, and transferring funds.

A multi-currency account can help streamline how you send, spend, receive or save money. Whether using it personally or for business, a global currency account provides added freedom and removes borders. Here are a few ways a multi-currency account and card can help make your life easier.

Save money and spend in local currency internationally

We all know that Malaysians love to shop.

When the pandemic hit, many Malaysians transitioned from shopping in malls to online stores locally and internationally.

The pandemic spurred the transition to online shopping out of necessity, but it helped many Malaysians to purchase their favourite items even from the comfort and safety of their homes.

However, it can be frustrating when dealing with uncertain conversion rates and hidden fees. Hence, a great way to navigate this is by choosing to pay in the currency of the country you are buying from – here’s where your multi-currency account comes in.

Pay like a local to save money on extra fees and get a better exchange rate!

Be in control of your finances when travelling abroad

Many Malaysians have been hit with the travel bug after the pandemic and plan their vacations meticulously.

As such, if you are looking to travel overseas, owning a multi-currency card will help you to spend in multiple currencies, whichever country you are in, with better exchange rates that are often lower than your traditional bank.

You don’t have to worry about fraud as you are always in control when using a multi-currency account, with instant transaction notifications and the ability to freeze your card instantly.

You can also spend like a local, using your card to withdraw money from your multi-currency account at ATMs worldwide.

Get paid like a local even from overseas clients

Freelancing is a great way to support a lifestyle outside the traditional office job. For many, it is also an opportunity to work with exciting companies in different countries.

It also means having the liberty to go about your day, but at the end of the day, you are responsible for maintaining a continuous flow of work. Expanding your horizon to regional or global clientele could yield better results and pay.

But it brings up the question of how you get paid.

Most companies seek to pay their freelancers in their local currency. So that’s where a multi-currency account comes in, allowing you to receive your salary and invoice payments in their local currency.

Conversion of these payments to your local currency means there are no more hefty bank fees or unfair exchange rates on both sides.

Save money when managing overseas property remotely

Once you purchase properties abroad, you may consider paying utilities, taxes, and other mandatory fees the most convenient way.

It is often stressful trying to decipher the uncertain and hidden charges that come from doing a bank money transfer. After all, no one wants to pay more than necessary, as it would only result in a loss of money.

These uncertain and hidden charges are especially true if you bought the property as an investment and turned it into an Airbnb or event rental space.

A great option to manage these properties is with a multi-currency account, where you can pay in local currency, receive money locally, and then convert it into your desired currency when the rates are proper.

Make it simple, take the hassle out of property management, and save money.

Selecting a multi-currency account that allows you to hold, receive or convert various currencies at the lowest rates possible is essential.

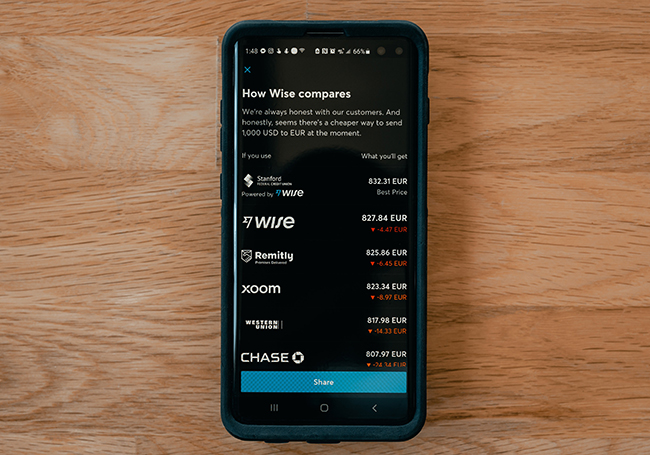

With Wise, you can enjoy the mid-market exchange rate for transfers, conversions and more without hidden fees. Another feature to look out for is 3-D secure authentication, which ensures every transaction is safe.

So, if you want to make international transactions from the comfort of your home or travel the world to see for yourself, it would be wise to own a multi-currency account.