While day trading as a side job can be fun and rewarding, it is critical to have the necessary tools and technology available, whether for stock or forex trading. If you want to start day trading, this post will go through some of the tools you’ll need.

Reliable computer software

You’ll be spending a lot of time in front of your computer as a day trader, so it’s critical that it’s a dependable and powerful machine that can manage the demands of trading software and many browser tabs. To readily access all of your data, you need a computer with a fast CPU, plenty of RAM, a large screen with a good resolution, and plenty of storage space.

A Continuous Online Experience

Day traders need a steady and fast internet connection to make investments without wasting time. A sluggish or inconsistent connection may cause you to miss out on opportunities or make costly mistakes. Consider upgrading to a more robust data plan or establishing an Ethernet link for maximum performance.

A Commercial Transaction

You will need to utilize a trading platform to make any buys or sells. Several alternatives are available to you, ranging from simple platforms with minimal functionality to complex platforms with a comprehensive array of instruments and sources. Determine which features are most essential to you, and then choose a platform that can provide those features while remaining within your budget.

A Trading Account Through a Broker

Before starting trading, you must create a brokerage account with a business that deals in the assets you wish to trade. There is a vast pool of brokers to choose from; thus, comprehensive research is essential to select the one most suited to your demands. Consider the types of assets available, the pricing, the level of customer service, and the trading tools and resources available to you.

Material and Equipment Trading

In addition to a trading platform, you can access many materials that may help you improve your trading outcomes and make better decisions. You might find websites with financial news and analysis, trading forums, and learning tools like books and online courses in this category.

A Strategy and a Budget

Before entering the trading market, it is critical to have a strategy and a financial plan in place. You may use this to create objectives, plan for challenges, and keep moving ahead. Before you begin, you should know what you’re getting into and comprehend the dangers and rewards of day trading.

Day trading may be profitable, but you must have the tools and attitude to get started. You will be well-equipped to reach your trading goals if you have a reliable computer, a fast internet connection, a trading platform, a brokerage account, trading tools, and trading knowledge.

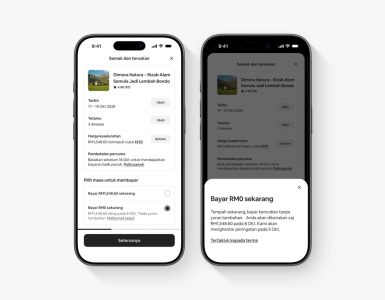

Mobile-Based Retail Application Use Cases

The flexibility to conduct business on the road is vital in today’s fast-paced and mobile workplace. Many trading platforms now provide mobile applications that enable traders to track and execute deals from their mobile devices. Because these mobile applications frequently offer the same feature set as the desktop version, you can effortlessly execute trades and access essential information no matter where you have a cell connection.

Portfolio Management Instruments

You should manage your portfolio’s success by employing techniques that can help you decrease your exposure. Examples include “stop loss” orders, which allow you to choose a price at which the transaction will be terminated if the market swings against you. Certain trading platforms include position sizing calculators and other trade management tools that may help you make educated decisions regarding the size of your trades in relation to your account balance.

A trading platform that is totally automated

Several applications are now available that may execute transactions on your behalf depending on the parameters you provide, allowing you to automate your trading process. Expert advisors (or “bots”) are handy computer programs that may be configured to do specified activities or follow a predefined trading strategy automatically. However, it is critical to be aware of the dangers of automatic trading, as unforeseen market circumstances or technical faults might occur at any time.

It may be beneficial to form a network of fellow company owners to whom one can turn for guidance and assistance in times of need. You can join a trading group, seek a trading mentor, or register for a trading forum. A group of experienced traders may be a great resource for learning new tactics, obtaining critical feedback on your trades, and retaining your excitement and drive.

To summarize, if you want to make day trading a lucrative side business, you’ll need access to the correct tools and knowledge, a well-thought-out plan, adequate finances, and the support of an encouraging community. If you commit to learning the ropes and investing in the necessary resources, you will be well-positioned to succeed in the exciting and potentially profitable world of day trading.