Tune Protect Group (Tune Protect) and Credit Guarantee Corporation Malaysia (CGC) have solidified a strategic partnership aimed at providing innovative digital insurance solutions tailored for Micro, Small, and Medium Scale Enterprises (MSMEs).

Tune Protect, a vertically integrated insurer, offers a spectrum of insurance services, including General and Life insurance, Reinsurance, and Insurtech solutions. On the other hand, CGC is a developmental financial institution that focuses on providing guarantees and credit financing to MSMEs.

This collaboration was formalized through a Memorandum of Understanding (MOU) signing ceremony in Petaling Jaya, with the shared goal of enhancing the accessibility of insurance solutions for MSMEs, thereby fortifying their businesses and employees and contributing to a more resilient economic landscape.

Tune Protect empowering MSMEs through digital insurance

This strategic alliance harnesses the combined expertise and resources of Tune Protect and CGC to create innovative insurance offerings tailored to the evolving needs of the MSME community.

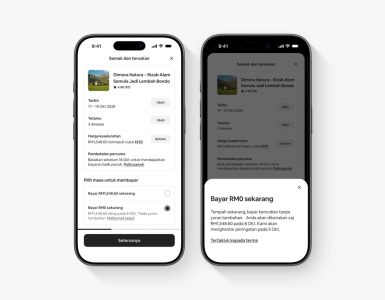

Tune Protect is initially offering two of its digital propositions, SME Business Shield and SME EZY, to help MSMEs manage their business risks and safeguard their employees’ well-being and health. These digital-led initiatives aim to simplify the insurance journey for MSMEs, making it more accessible, affordable, and less complex. This will enable MSMEs to explore insurance products to protect their businesses and employees effectively.

Rohit Nambiar, Group CEO of Tune Protect, emphasized the importance of MSMEs in Malaysia’s economic growth and highlighted their vulnerability to risks due to limited insurance coverage.

He expressed Tune Protect’s commitment to this vital community and their dedication to making insurance more accessible. This collaboration aims to provide MSMEs with the knowledge needed to make informed decisions about their insurance coverage.

Knowledge sharing and capacity building

The collaboration between Tune Protect and CGC extends beyond insurance offerings. It places a strong emphasis on knowledge sharing and capacity building as pillars of support for the MSME community.

Tune Protect will participate in CGC’s outreach programmes for MSMEs, offering educational initiatives such as interactive workshops, training programs, and informative sessions.

These efforts aim to equip business owners with essential information and perspectives to secure cost-effective insurance coverage, protecting their operations, workforce, and physical establishments.

The collaborative events and workshops are designed to educate MSMEs across diverse sectors, including F&B, retail, e-commerce, wholesale distribution, and the automotive industry, among others.

Datuk Mohd Zamree Mohd Ishak, CGC President & Chief Executive Officer, acknowledged the evolving business landscape and the risks and uncertainties MSMEs face. He highlighted that many MSMEs are ill-equipped to manage these risks and emphasized CGC and Tune Protect’s commitment to enhancing awareness and business protection for MSMEs.

Through the imSME portal, MSMEs can now access affordable Tune Protect General and Life insurance plans via a self-service customer journey. The collaboration between Tune Protect and CGC is set to span three years, with a shared commitment to enhance the MSME landscape and contribute to economic growth in Malaysia.

To find out more about the MSMEs digital insurance propositions, please visit imsme.com.my/portal/insurance/.