After years of exclusively offering a web-only myBSN online banking portal, Bank Simpanan Nasional (BSN) has finally stepped into the mobile banking arena with the introduction of the myBSN mobile app for personal banking BSN account holders.

Distinguishing itself from BSN’s existing BSNeBiz Mobile app, designed specifically for corporate and SME clientele, the myBSN app aims to bridge the gap in mobile banking services for individual customers. This move comes as BSN was one of the few local banks without a dedicated smartphone app for personal banking clients.

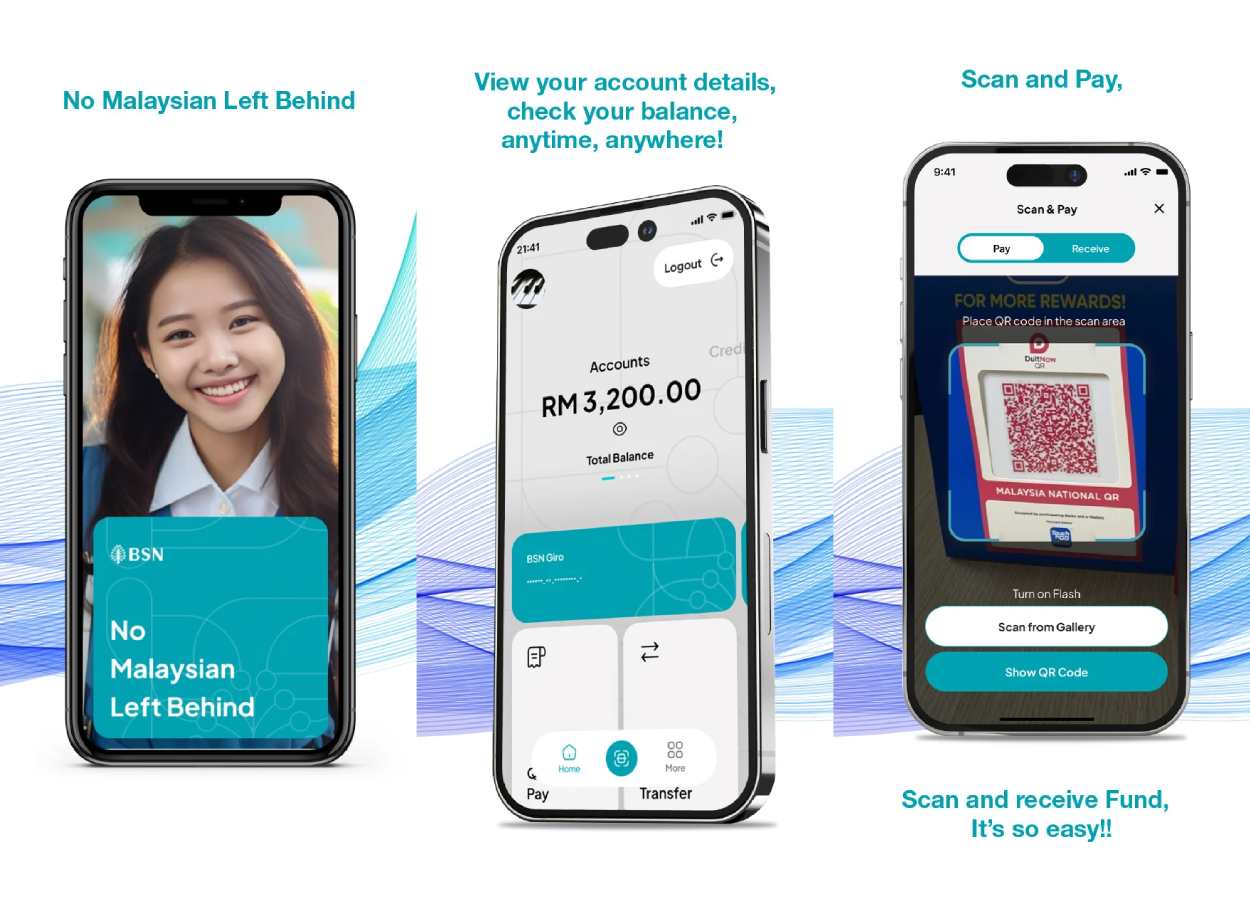

Available for download on both Apple and Android devices, the myBSN mobile app is poised to simplify access and enhance the user experience for consumer banking services. Users can now perform various tasks, including checking savings and credit card account balances, accessing transaction histories, and making QR payments directly from their mobile devices.

Closing the Mobile Banking Gap

In a notable departure from the myBSN internet banking portal, the mobile application introduces additional features such as fund transfers and credit card payments through DuitNow, enabling swift and seamless transactions.

Security takes center stage in the myBSN app, leveraging biometric identification with fingerprint and facial recognition to verify users’ identities on their mobile devices. To fortify security further, myBSN introduces the BSN Safe Switch – a self-service security feature that empowers users to block access to their accounts in real-time if they suspect any unauthorized activity, aligning with the industry trend.

BSN, established in 1974, has been a pivotal player in enhancing public access to financial services in Malaysia. Originally part of a broader government initiative to boost savings and investments among Malaysians, particularly within low and middle-income groups, the bank has continually evolved its services to meet the changing needs of its diverse customer base.