Boost Bank, Malaysia’s third digital bank, is set to launch on June 6, 2024, promising competitive interest rates and innovative savings features to attract customers. The bank will offer up to 3.6% p.a. daily interest on its deposit products, aiming to distinguish itself in the growing digital banking sector.

On its official website, Boost Bank highlighted that customers can earn up to 2.5% p.a. daily interest on their savings accounts. Additionally, a unique feature known as Savings Jars, designed for goal-based savings, will offer up to 3.6% p.a. daily interest.

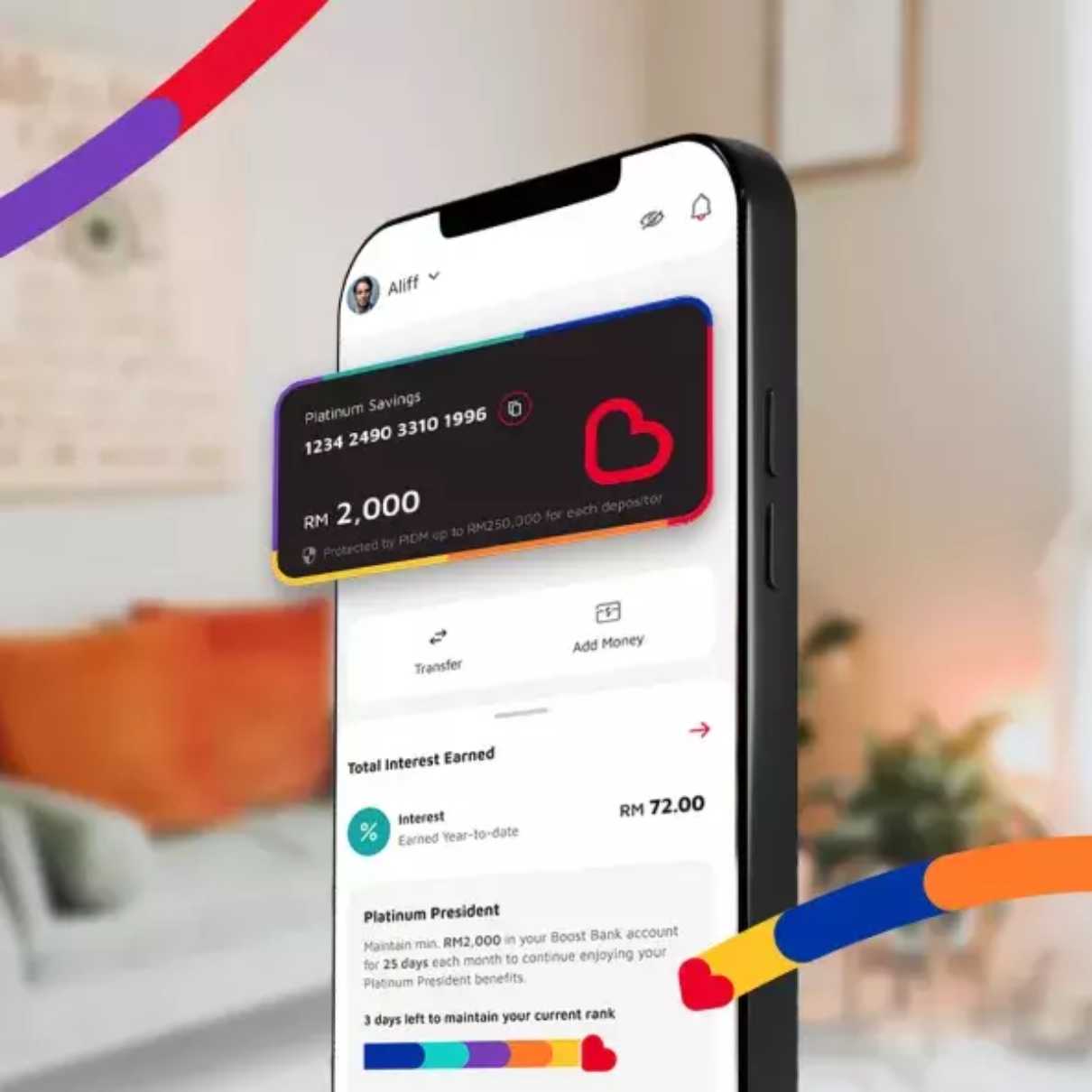

Premium benefits with Platinum President status

According to the bank’s terms and conditions, the actual interest rates will depend on a loyalty tier system, with the highest tier, Platinum President, providing the maximum benefits, including triple Boost Stars and other exclusive perks.

Achieving and maintaining Platinum President status requires some effort. Initially, customers who deposit and reach RM2,000 in their Boost Bank account will be automatically upgraded to Platinum President. For the remainder of the month in which they achieve this tier (Month 1), no specific balance maintenance is required. This status extends through Month 2.

However, to retain Platinum President status for Month 3, customers must maintain a minimum daily balance of RM2,000 for at least 25 days during Month 2. Failure to meet this requirement results in a downgrade to the Basic tier at the start of Month 3, forfeiting Platinum President privileges.

“Once a user has been downgraded from Platinum President to Basic, they can regain Platinum President status by maintaining a minimum end-of-day balance of RM2,000 for 25 calendar days within any calendar month. Upon meeting this requirement, their status will be immediately upgraded to Platinum President,” Boost Bank clarified in its document.

The bank’s terms and conditions also allow customers to create up to eight Savings Jars simultaneously. Account balance and transaction limitations will vary depending on how the Boost Bank account is activated. An annual dormant charge of RM10 will apply to accounts with no transactions for 12 months.

Debit Card Design Poll

In a recent engagement with its community, Boost Bank posted a poll on social media, inviting followers to vote on the design of its upcoming debit card. The choices are between a sleek black card with a red logo (Team Black) and a vibrant red card with a white logo (Team Red).

Boost Bank will join the ranks of GXBank and AEON Bank, Malaysia’s other digital banks. GXBank began serving the public in November 2023, and AEON Bank launched last week. The Malaysian digital banking landscape is poised to expand further, with a total of five digital banks set to operate in the country.

As Boost Bank prepares for its launch, the competitive interest rates and customer-centric features aim to capture a significant share of the digital banking market, offering Malaysians innovative ways to manage and grow their savings.