GXBank, Malaysia’s first digital bank licensed by Bank Negara Malaysia, is revolutionising digital banking with its new GX Card.

Offering a range of benefits, including high-interest rates, unlimited cashback, and fee-free ATM withdrawals, GXBank aims to provide customers with a seamless and rewarding banking experience.

GX Card: A new standard in digital banking

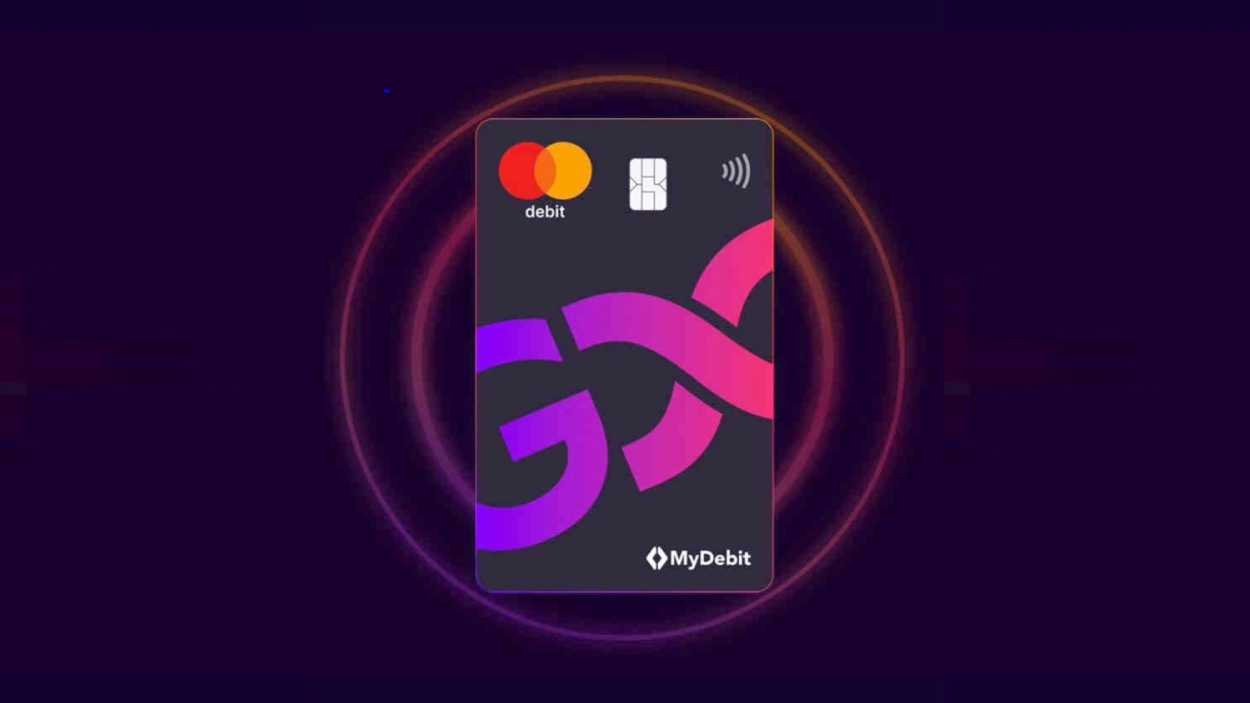

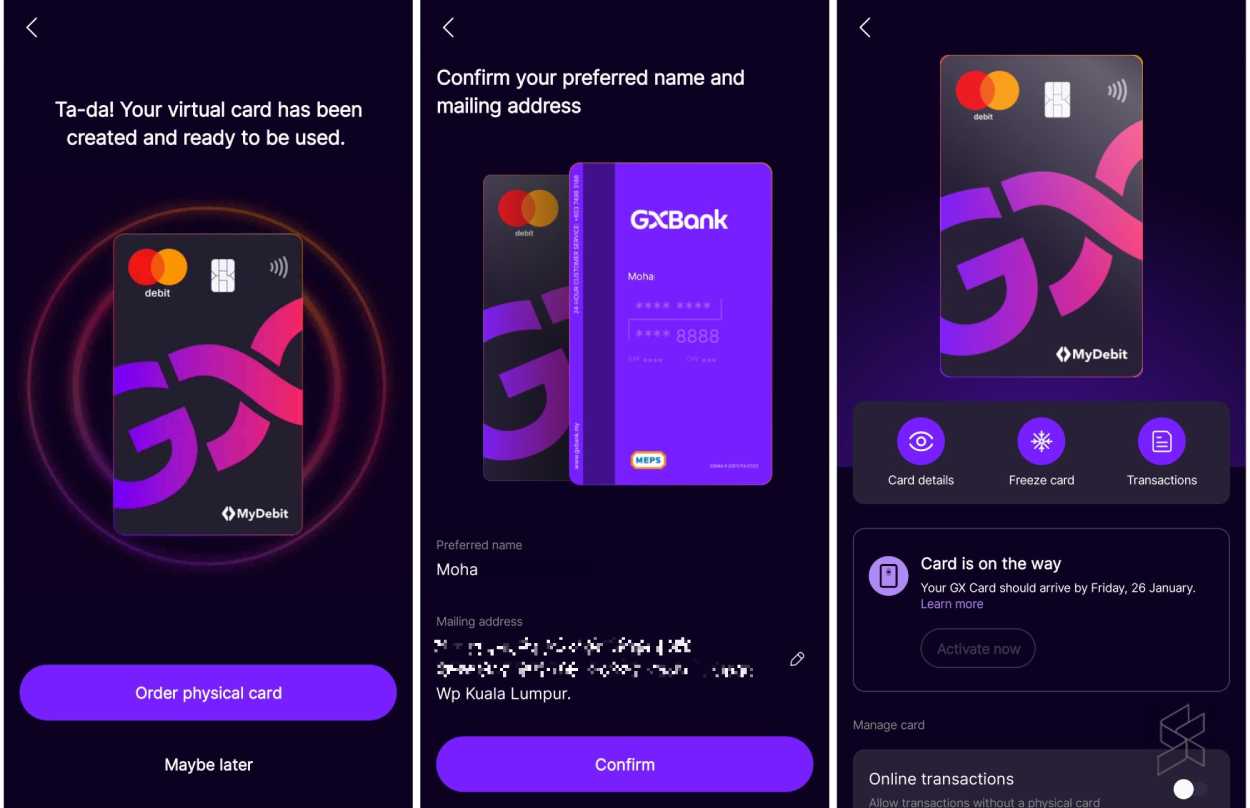

The GX Card, a physical Mastercard debit card, is now available for free through the GXBank app to the first batch of customers.

Designed with a sleek, modern aesthetic, the card features a reflective GX logo in gradient purple and red on a black background.

The rear of the card features all purple design, displaying the cardholder’s preferred name, card number, expiry date, and CVC.

The card’s maroon edges help it stand out in any wallet. Activation is straightforward via the app, requiring only the setting of a PIN.

Innovative savings and cashback benefits

GXBank stands out by offering an attractive 3% p.a. daily interest on all account balances, applicable to both Main Accounts and Savings Pockets.

The bank’s approach to savings is straightforward and user-friendly, with no fees, no conditions, and no minimum balance requirements.

As part of its introductory promotion, GXBank is offering unlimited 1% cashback on card spending.

This means customers can receive RM1 cashback for every RM100 spent, although this excludes certain transactions like eWallet top-ups.

Additionally, GXBank provides 1.5x GrabRewards points for purchases made at Jaya Grocer retail outlets.

To earn the cashback reward, simply register or switch your Duitnow ID (Mobile Number/ MyKad) to your GX Account.

Once you have successfully registered your Duitnow ID, you will receive RM8 cashback credited to your GX Account within the same day or one day from the date of your registration.

GX Bank: User-friendly features and enhanced security

In a move to enhance convenience, GXBank is waiving cash withdrawal fees at MEPS ATMs nationwide and is not charging extra transaction fees for overseas transactions and cash withdrawals at Mastercard ATMs worldwide.

This makes the GX Card an ideal choice for both domestic and international use.

GXBank provides robust security features, allowing users to lock and secure their accounts in case of fraudulent or unauthorised transactions.

Users can also set daily spending limits to manage their budgets more effectively.

Additional perks include a cashback reward of RM20 with a minimum deposit of RM100 and a complimentary GrabUnlimited subscription for up to six months.

“Security and ease of use are our top priorities,” said the GXBank representative. “We want our customers to feel safe and empowered in their financial decisions.”

Future plans and customer assurance

Currently, GXBank focuses exclusively on savings accounts and does not offer options for DuitNow QR spending or online/offline debit Mastercard or Visa transactions.

During its beta-testing phase, users can create a GXBank Savings Account and up to 10 “Pockets” for managing their savings goals.

All deposits are protected up to RM250,000 per depositor by Perbadanan Insurans Deposit Malaysia (PIDM).

GXBank also plans to waive the RM1 processing fee for cash withdrawals at MEPS ATMs nationwide soon, further enhancing the value proposition for its customers.

GXBank’s GX Card offers an innovative approach to digital banking in Malaysia, with significant savings through unlimited 1% cashback, high-interest rates, and no hidden fees.

With accessibility to over 10,000 MEPS ATMs and the promise of enhanced financial security, GXBank is setting a new standard in digital banking.

For more information and to apply for the GX Card, visit the GXBank website and claim RM8 cashback.

You can also use Referral Code: g95fc90f0gb56fd1d9fg583db52c83g3