The emergence of GenAI is reshaping the landscape of artificial intelligence, offering exciting new possibilities for businesses and finance.

Unlike traditional AI, which operates within predefined rules and data parameters, GenAI can generate entirely new content, marking a significant leap forward in AI capabilities.

This innovative technology promises to revolutionise how we approach problem-solving and content creation across various sectors.

The promise of GenAI for businesses

GenAI holds particular promise for Malaysia’s small and medium enterprises (SMEs), which are the backbone of the nation’s economy, representing 97% of all businesses and employing nearly half the workforce.

These SMEs often face challenges due to limited resources and economies of scale.

GenAI offers a solution by automating routine tasks, enhancing accuracy, and providing valuable insights with minimal resource requirements.

This can help level the playing field, allowing SMEs to compete more effectively against larger corporations.

Traditional AI relies on specific data sets and predetermined rules, requiring extensive time and labelled data to develop effective models.

In contrast, GenAI uses foundation models capable of processing vast amounts of unstructured data.

Through “prompt engineering,” it can perform multiple tasks simultaneously, facilitating faster development and broader application.

This capability makes GenAI a powerful tool across various applications, from generating reports to developing new content.

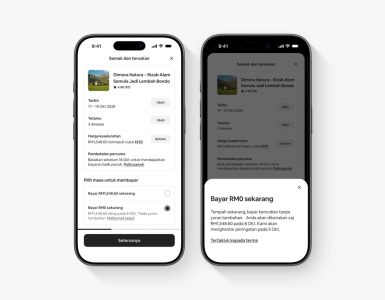

The integration of GenAI into finance operations is transforming the field. Traditional AI applications in finance manage tasks like time tracking and reconciliations.

GenAI extends these capabilities, automating the creation of comprehensive reports, extracting critical information for credit decisions, and developing detailed investor relations documents.

This shift allows finance professionals to focus on interpreting data and making strategic decisions, rather than spending time on routine tasks.

For instance, organisations are now using GenAI to streamline operations, enabling finance professionals to analyse financial trends and provide strategic advice.

This transformation is akin to the evolution from manual to automated processes, enhancing efficiency and allowing finance experts to contribute more significantly to business strategy.

Practical applications and ethical considerations

The practical applications of GenAI are already being realised.

For example, a global insurance company used GenAI to overhaul their call centre operations, handling complex tasks such as account matching and summarising key information from contracts.

This not only streamlined operations but also improved customer satisfaction.

However, as GenAI becomes more integrated into business processes, ethical considerations become crucial.

The Institute of Chartered Accountants in England and Wales (ICAEW) is developing guidelines to ensure ethical AI use, focusing on the limitations of AI and the need for human judgement.

The introduction of mandatory Ethics CPD and an AI and Ethics CPD module will support professionals in making informed decisions regarding AI applications.

While GenAI offers substantial benefits, including automation of repetitive tasks and efficient data handling, it also presents challenges such as security risks, potential biases, and over-reliance on technology.

Implementing robust security measures and conducting regular audits of AI models are essential to address these risks.

Retrieval-Augmented Generation (RAG) is one promising approach to ensuring AI-generated content is backed by reliable sources, enhancing the credibility and traceability of information.

Successfully integrating GenAI into business operations requires a cultural shift. Leaders must champion AI initiatives and foster a culture of experimentation and agile development.

Businesses should conduct proof-of-concept projects and iterate quickly to build confidence in AI technologies.

The adoption of GenAI can be likened to the transition from basic mobile phones to smartphones, revolutionising communication and productivity.

In conclusion, GenAI stands poised to be a game-changer in business and finance.

Its ability to generate new content and insights can streamline operations, enhance decision-making, and drive innovation.

While challenges remain, careful implementation and a supportive organisational culture will ensure that GenAI becomes an integral part of the corporate toolkit, shaping the future of work and finance.

Karen Ko is an ICAEW Fellow Chartered Accountant and Managing Director of APAC

Financial Services Transformation & HK Business Transformation Consulting Leader,

Protiviti