GXBank recently celebrated its first anniversary as Malaysia’s premier digital bank, with CEO Pei-Si Lai announcing close to one million customers, over 24 million transactions, and nearly 900,000 savings accounts set up.

At the anniversary event, named “GX 2.0,” GXBank introduced a series of innovative financial products aimed at providing customers with more flexible and convenient digital banking solutions.

New offerings: GX FlexiCredit and GX Biz FlexiLoan

GXBank’s latest product, GX FlexiCredit, promises instant approval and quick access to cash for eligible customers.

This offering allows qualified users to secure up to RM15,000 in credit within minutes, with flexible drawdown options and no early repayment fees.

“This is all about flexibility,” GXBank emphasised, noting that interest applies only to the withdrawn amount, making it a practical choice for customers needing immediate funds.

For small businesses and micro-entrepreneurs, the GX Biz FlexiLoan provides an accessible funding option with credit lines of up to RM150,000 and loan terms extending to three years.

Small business owners will enjoy fee-free early repayments, and initial access to GX Biz Banking will be extended to merchants in the Grab Malaysia ecosystem.

Nationwide expansion is expected by early 2025, offering broader support to Malaysian entrepreneurs.

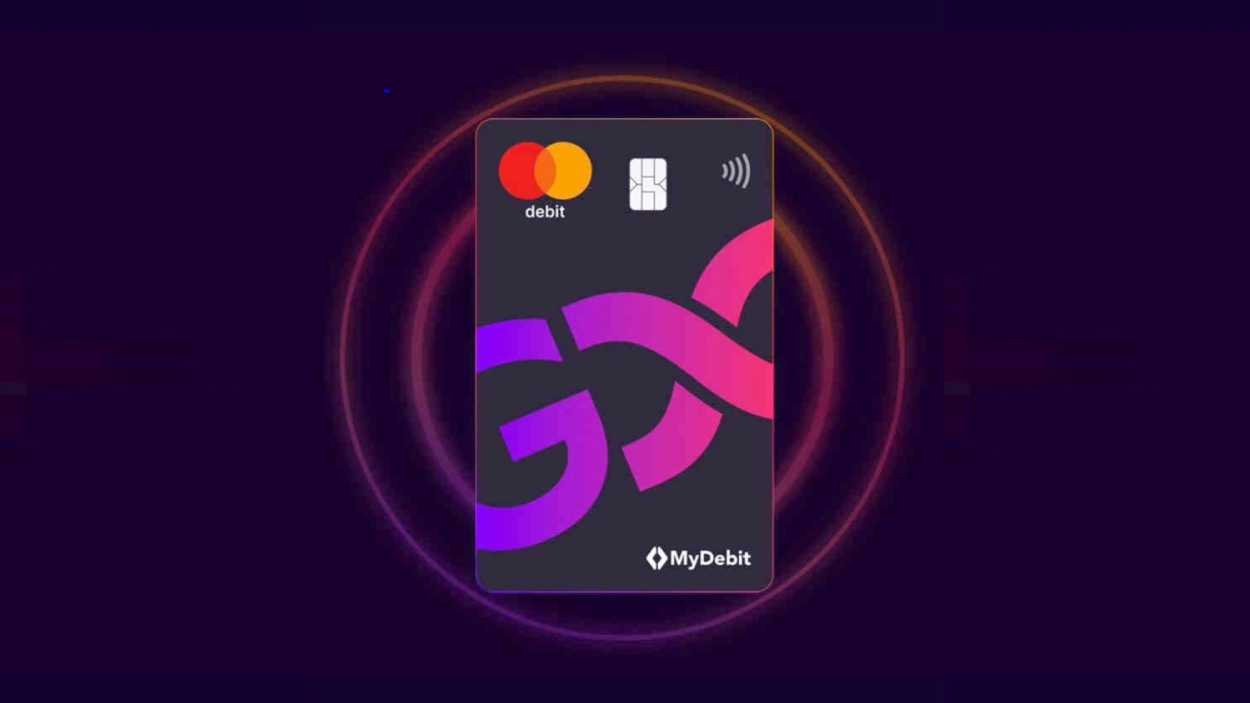

Enhanced debit card perks for GXBank users

Starting tomorrow, GXBank customers can enjoy a refreshed debit card with enhanced cashback and rewards.

Key benefits include 0.1% instant cashback on all purchases, 1% cashback on overseas in-store spending, and a generous 3x GrabRewards on overseas Grab transactions.

Additional features include zero foreign exchange markups, free overseas ATM withdrawals, and no annual or issuance fees, which GXBank expects will appeal to frequent travellers and everyday users alike.

The updated debit card also offers unique rewards for grocery shopping, with 1.5x GrabRewards on purchases at Jaya Grocer.

These incentives underscore GXBank’s commitment to enhancing everyday value for its customers through seamless, cost-effective digital banking.

GXBank also revealed future digital enhancements, including an AI-powered chatbot named AIni.

Capable of understanding English, Bahasa Malaysia, and even Manglish, AIni is designed to assist customers more interactively and accessibly.

Other planned updates include badge rewards to gamify the banking experience and GXWrapped, a feature providing users with a year-end summary of their financial activity on the platform.

Although GXBank hasn’t set a timeline for these updates, they promise to enrich the overall user experience.

With its expanded offerings and upcoming digital tools, GXBank aims to set a new standard in digital banking for Malaysians.

For more information and to apply for the GX Card, visit the GXBank website and claim RM8 cashback.