Maybank has launched Money Lock, an innovative security feature on its MAE App, marking a significant step forward in combating the rising threat of online scams. This first-in-Malaysia solution, building on its successful introduction in Singapore mid-2024, allows customers to secure their funds digitally while maintaining access to other banking conveniences. With online fraud becoming increasingly sophisticated, Money Lock offers an effective and user-friendly safeguard for Malaysian consumers.

The feature empowers users to lock specific amounts in their savings or current accounts, shielding those funds from digital access. From RM10 to the entire account balance, customers have the flexibility to tailor their security settings. Crucially, locked funds remain eligible for interest or profit rates, ensuring financial growth isn’t compromised.

Key Features and Activation Process

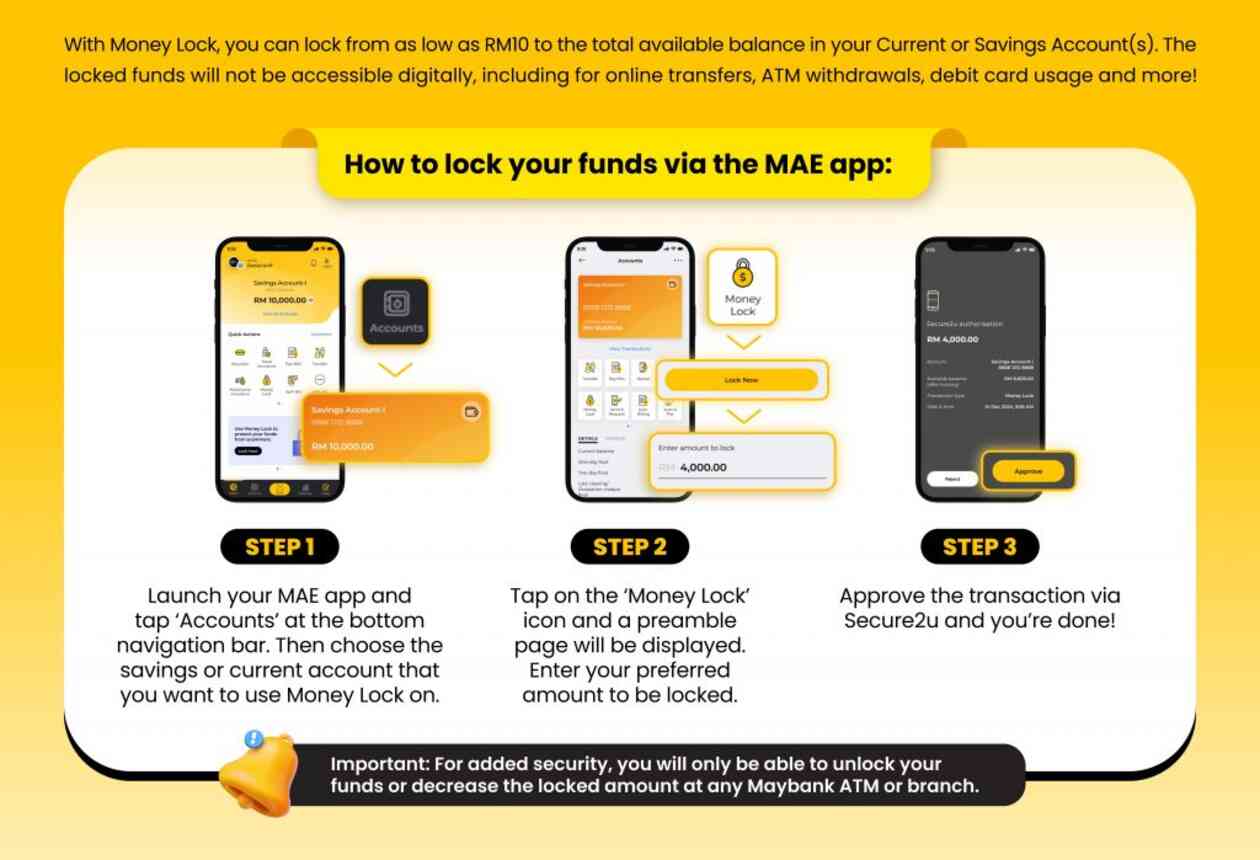

Money Lock is designed to be intuitive and accessible, making it easy for customers to enhance their account security. Through the MAE App, users can activate the feature in a few simple steps:

- Navigate to the “Accounts” tab and select the desired account.

- Tap the Money Lock icon, specify the amount to lock, and confirm via Secure2u.

- Funds are immediately shielded from online banking transfers, ATM withdrawals, debit card payments, and other digital transactions.

To unlock or adjust the locked amount, customers must visit a Maybank ATM or branch for verification, adding another layer of security against unauthorized access. This seamless yet secure process underscores Maybank’s commitment to safeguarding its customers.

Targeting Vulnerable Groups and Evolving Threats

Money Lock is particularly beneficial for customers at higher risk of online scams, such as senior citizens and individuals less familiar with digital platforms. The feature provides these groups with an extra layer of protection, giving them peace of mind while navigating online banking.

This feature complements Maybank’s broader fraud prevention strategy, which includes Secure2u authentication, device restrictions, and malware shielding within the MAE App. These initiatives aim to address evolving cyber threats comprehensively, ensuring a safer digital banking environment for all customers.

Ensuring Financial Security and Planning

While Money Lock enhances account security, Maybank advises users to plan their finances carefully before activating the feature. Customers should ensure that sufficient funds remain accessible for essential transactions to avoid disruptions.

Maybank also continues to emphasize the importance of customer awareness in combating fraud. Through public campaigns, the bank encourages users to stay vigilant, avoid sharing banking credentials, and only download official applications.

As Maybank expands its suite of fraud prevention measures, Money Lock exemplifies how financial institutions can balance convenience with security, setting a benchmark for the industry. To learn more about Money Lock and its benefits, customers can visit Maybank’s official website.

With Money Lock, Maybank is redefining how Malaysians approach online banking, providing them with the tools they need to protect their funds confidently and effectively.