House prices in Malaysia continue to surge and making it unaffordable for the average Malaysian especially the lower and middle income groups.

Almost all of the newly launched apartments in the Klang Valley being priced in excess of RM500,000, and it is almost impossible for many to own their own homes.

According to National House Buyers Association (HBA), unless strong measures are taken by the government to address the issue of steep rise in house prices, Malaysia risk facing a “homeless generation” that can cause various social issues with far reaching complication.

Kuala Lumpur’s house price index rose especially dramatically, with nominal prices up by 14.4%.

Spending power

According to Valuation and Property Services Department (JPPJ), Kuala Lumpur has the most expensive houses in the country, with an average house price of RM 620,758 followed by Sabah and Selangor with average prices of RM 413,187 and RM 405,826.

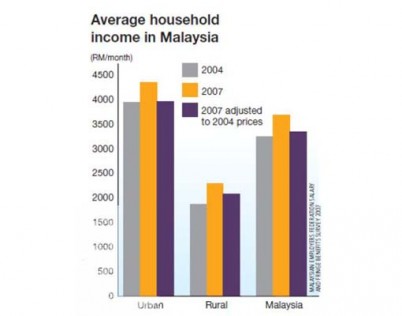

Back in March 2013, the 2012 Household Income Survey showed that the Malaysian household monthly income rose from RM 4025 in 2009 to RM 5000 in 2012. It’s a 7.2 per cent increase in total, and it was even announced that all states in Malaysia recorded better average monthly household incomes with Kuala Lumpur leading with the highest growth of 14.9 per cent from RM5488 to RM8586.

Overall, the increase is a positive one, with credits due to stable and strong economy.

However, prospective house buyers must save up for their future purchase the moment they start working and forgo certain luxuries such as electronic gadgets and non-national cars, said HBA.

Eventhough the government introduced stronger measures in Budget 2014 to address rising house prices such as increasing the Real Property Gains Tax (RPGT) and higher threshold for foreigners to buy properties and banning of the Developer Interest Bearing Scheme (DIBS) but it did not stop property speculations.

HBA also said that if the developer prices the property lower without the cost of the freebies and rebates and house buyers can then plan and budget their purchase accordingly and need not have to pay so much in monthly loan instalments.

“The situation in Malaysia isn’t ideal. We all wished we could have the same sort of spending power as other countries but on the bigger perspective, Malaysians aren’t the only ones having it tough. Though yes, there are still many ways of which Malaysia is definitely lacking and undoubtedly a number of items 10 cents, showing that even America isn’t immune to rising prices,” said Boon Kia Meng, 35, a lecturer turned film director, who produced a documentary on the ability to own a house with the current market situation.

“Malaysians as tax payers should start taking charge of your life. Don’t be driven by what the developer’s say,” he added.

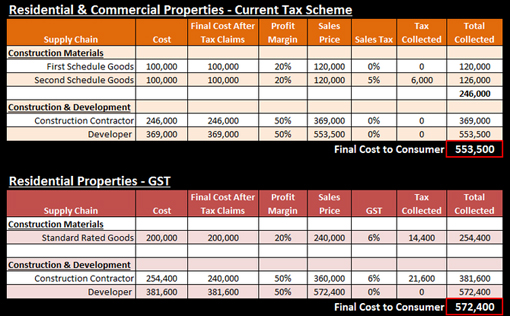

Will GST increase housing price?

The implementation of Goods & Services Tax (GST) in April 2015, has made it even more difficult for many potential house buyers, as it will affect home and property price in general.

In a report published by Malaysian Reserve, Real Estate and Housing Developers Association (Rehda) deputy president Datuk Seri Fateh Iskandar Mohamed Mansor said that small developers would initially bear the cost of GST for building materials but it will be inevitable that they would pass it on to the end-buyers, which would push up property prices.

He said even without the pass-on effect, the perception that property prices will go up after April next year would trigger a rush of buying from buyers as well as speculators that would result in overpricing, which in turn would be bad news for the buyers and industry as well.

This will eventually add to living costs and create more constraints to lower-income earners.