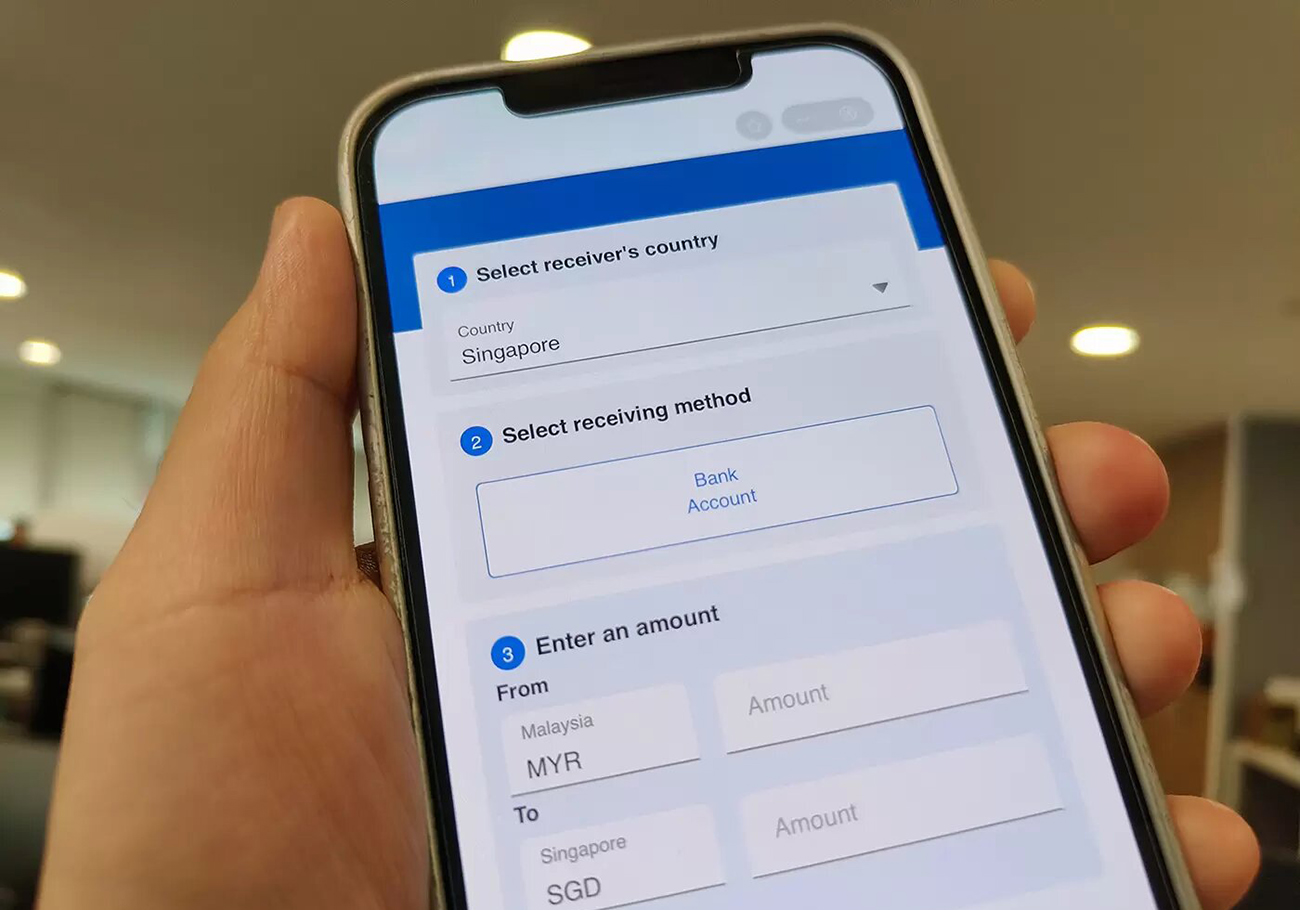

TNG Digital Sdn Bhd, the driving force behind Touch ‘n Go eWallet, is proud to unveil its latest innovation, GOremit. This digital remittance service is poised to transform cross-border money transfers with its secure and user-friendly platform.

With the goal of fostering inclusivity and innovation, TNG Digital has introduced GOremit to allow users to send money seamlessly to various Southeast Asian countries. This breakthrough service caters to foreign workers, international students, expatriates, and underserved communities, providing them with a reliable means to send funds to their home countries or loved ones.

The launch of GOremit signifies TNG Digital’s unwavering commitment to redefining financial solutions, further enriching its comprehensive suite of services tailored to meet the evolving needs of its diverse user base.

GOremit: Seamless international remittance

GOremit allows users to securely send money to several Southeast Asian countries, including Indonesia, the Philippines, Singapore, Thailand, Vietnam. Additionally, users can send funds to other Asian regions such as Bangladesh, India, Nepal, Pakistan, and Sri Lanka.

Alan Ni, Chief Executive Officer of TNG Digital, highlighted, “With GOremit in the Touch ‘n Go eWallet, users and merchants can remit money to 10 countries from a convenient and safe platform.

We are providing an inclusive solution with competitive exchange rates that meet the needs of millions of foreign workers that are here in Malaysia. Users who have the need to transfer money conveniently to their children studying abroad or transfer on behalf of their domestic helpers can do so via GOremit.”

The introduction of GOremit is in line with TNG Digital’s broader financial inclusion agenda. This service targets underserved communities, foreign workers, international students, and expatriates, providing them with a secure and user-friendly option to send money to their home country or loved ones.

Comprehensive and secure transactions

To utilize GOremit services, senders need to complete verification through eKYC. They can choose to transfer funds to the recipient’s bank account, local eWallet, or cash pick-up points. Presently, bKash in Bangladesh, GCash, and PayMaya in the Philippines are the supporting e-wallets. Recipients can expect to receive their funds within 15 minutes, depending on their chosen collection method.

Alan Ni added, “With the introduction of GOremit to our financial services portfolio, we are closer to becoming the go-to alternative to traditional banking solutions. We have plans to introduce more partners and expand this service to more countries in the future.”

Transactions are conducted securely through the Touch ‘n Go eWallet, with users receiving push notifications to track the progress of their money transfer. The platform also allows users to view their transaction history and obtain receipts through their registered email.

Users can easily manage receivers, adding new profiles or removing existing ones through the eWallet interface. Additionally, the service allows users to receive funds from overseas in real-time, offering great value for international students and individuals needing to receive money directly in their eWallet.

With the integration of GOremit, the Touch ‘n Go eWallet continues to expand its suite of financial products and services, offering investments, insurance, lending, and payment solutions tailored for diverse user segments.

GOremit’s introduction marks a significant stride as the Touch ‘n Go eWallet now encompasses both inbound and outbound remittance, further enhancing its comprehensive and inclusive financial ecosystem. The move reflects the company’s commitment to innovation and meeting the dynamic needs of its users through seamless, secure, and efficient financial solutions.