Agensi Kaunseling dan Pengurusan Kredit (AKPK) and Delivery Hero Malaysia Sdn. Bhd. (foodpanda), in collaboration with Bank Simpanan Nasional (BSN) launched the Go Giggers Financial Literacy Programme 2024 to provide awareness to gig workers on prudent financial management.

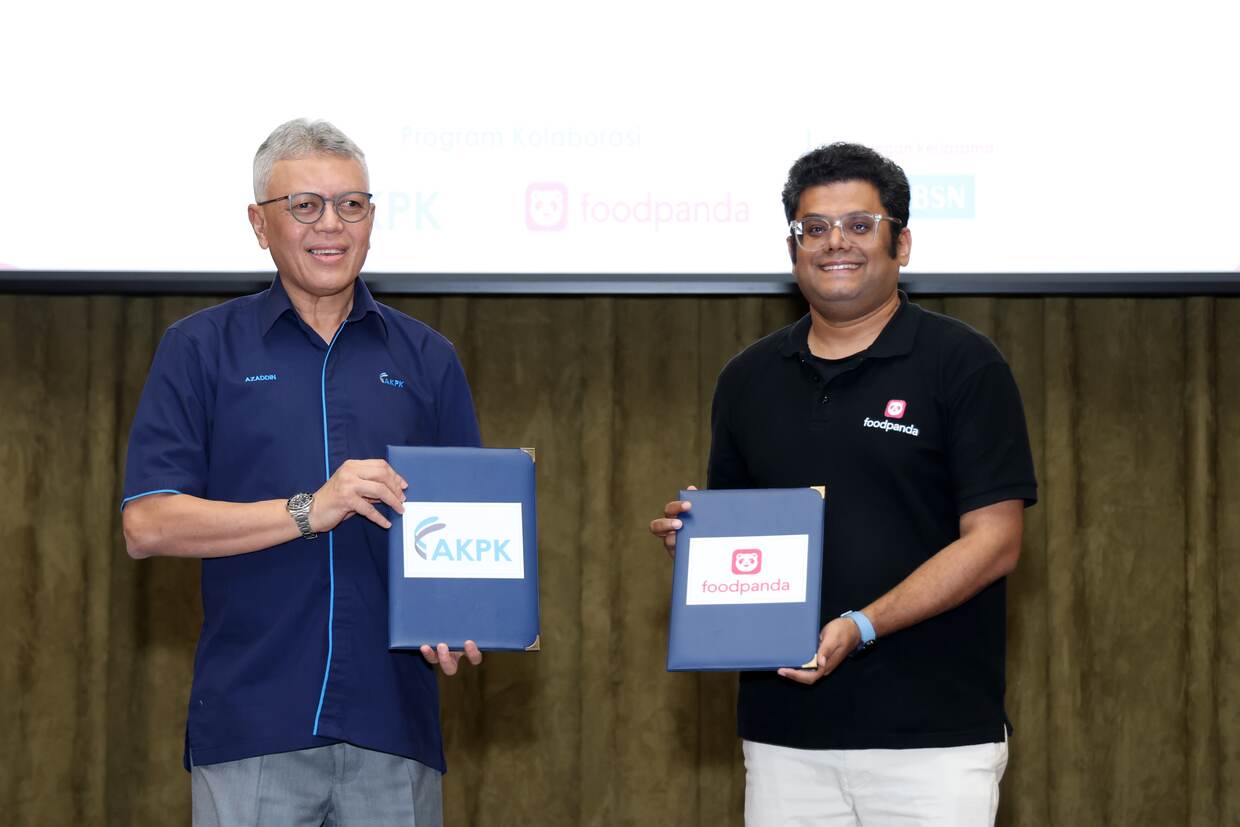

The programme was launched together with the signing of a collaboration note by Chief Executive Officer of AKPK, Azaddin Ngah Tasir; Chief Executive of Bank Simpanan Nasional, Jay Khairil Jeremy Abdullah, and Director of Operations of Delivery Hero Malaysia Sdn. Bhd. (foodpanda), En. Shubham Saran.

AKPK always cares about the financial problems facing Malaysians from all walks of life considering the current uncertainty in the global economy. This is in line with the concept of inclusivity firmly held by AKPK, that no one is left behind in attaining awareness and empowerment in financial literacy.

Financial literacy for Giggers

AKPK acknowledges the struggles that workers in the gig economy go through, including foodpanda riders, who provide frontline services to the public. Therefore, the Go Giggers Financial Literacy Programme 2024 is an appropriate initiative to reach out and guide the riders in facing current economic challenges.

AKPK’s General Manager of the Education and Outreach Division, Nor Fazleen Zakaria, said in her opening remarks, “The move is in line with AKPK’s mission to empower individuals with knowledge on personal financial management so that they will be more disciplined and responsible and can wisely overcome their financial situation.”

Gig workers’ savings challenges

A study entitled “A Case Study of Foodpanda in Malaysia — Financial Behaviour of Gig Workers” by METLIFE which involved one thousand (1,000) respondents found that more than half of the respondents spent within their means. However, only 30 percent (%) were regular savers, while another 61 percent (%) saved occasionally. Other respondents attributed their non-saving or irregular saving behaviour to insufficient funds.

Moreover, workers in the gig economy, including riders, missed out on many benefits attained by full-time workers. These include health coverage, retirement funds and paid medical leaves. Therefore, it is only fair that they are provided with awareness of the importance of proper financial management to ensure that they can sustain themselves when faced with unexpected circumstances. This programme also embeds elements of financial management that impress on high level of discipline and commitment in inculcating saving habits and prudent spending among riders.

In his remarks, Director of Operations of Delivery Hero Malaysia commented, “As we launch the GO GIGGERS GO RIDERS Campaign, I am proud to witness foodpanda Malaysia’s unwavering commitment to our delivery partners’ financial well-being. This partnership with AKPK and BSN is more than just a programme — it is a step towards empowering our riders with the knowledge and tools to navigate financial challenges confidently. It is also part of our Panda Hearts programme which is our flagship programme aimed at uplifting and supporting delivery partners. Our riders are the backbone of our operations, and through initiatives like these, we aim to support them not only in their work but in building a secure future for themselves and their families.”

Go Giggers programme targets 5,000 riders

The Go Giggers Financial Literacy Programme 2024 is a specially designed initiative which will benefit and provide exposure to more than five thousand (5,000) foodpanda riders on the importance of prudent financial management through sharing of infographics, edu-videos, as well as JomBorak podcasts, among others.

As a high-impact programme for the targeted group, especially foodpanda riders, those selected will be provided with intensive coaching for six (6) months through various educational means including gamification.

They will be monitored and evaluated, and their progress will be recorded to ensure that the coaching and guidance provided meet the programme’s objective, that is for the foodpanda riders to have adequate savings and emergency funds.

BSN tracks riders’ financial progress consistently

Meanwhile, our strategic partner BSN will provide the riders with a savings progress report for the duration of the programme. The report will be a benchmark in determining the riders’ consistency in building their savings and emergency funds.

Recently, on 6th August, AKPK organised a face-to-face financial education programme with more than 100 foodpanda riders. BSN also opened a counter to facilitate the riders in opening a savings account, in line with the programme’s objective. Other strategic partners present were Employee Provident Fund (EPF), Social Security Organisation (SOCSO), CTOS, the National Cancer Society of Malaysia and SETEL.

A programme of this kind is a testament to AKPK’s continuous proactive approach to providing Malaysians with exposure and empowerment in financial literacy. As of June 2024, 13.2 million Malaysians from all walks of life have been exposed to financial education programmes organised by AKPK.