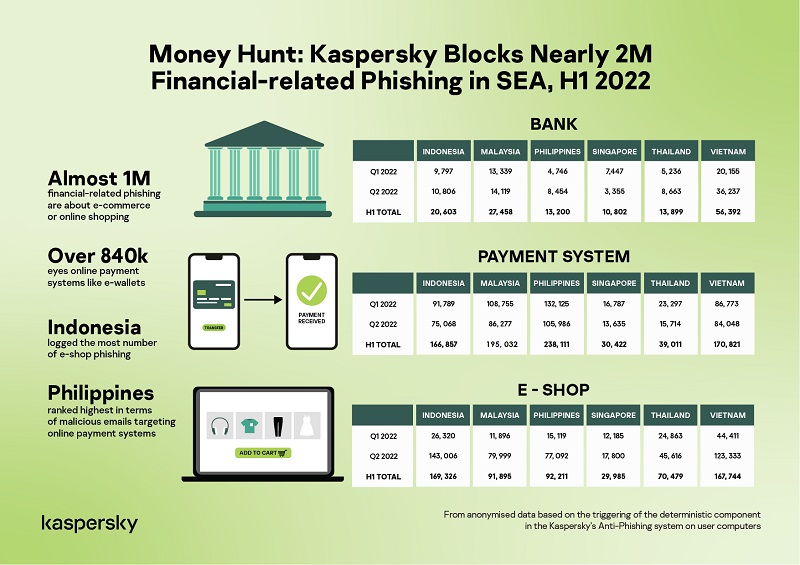

A total of 195,032 payment system-related phishing activities were detected in Malaysia in the first two quarters of 2022. According to Kapersky, 108,755 phishing activities were detected in quarter one and 86,277 in quarter two.

Findings of the global cybersecurity company aligns with the local trends in the country. The Inspector-General of Police earlier disclosed that a total of 48,850 online frauds were reported from 2020 till May this year, or 68% of the total 71,833 commercial crime cases reported.

Two of the prominent online payment providers in Malaysia experienced cybersecurity breaches back in August. The Bank Negara Malaysia, on the other hand, has given the assurance that the bank’s payment systems remain safe and secure.

During the first six months of 2022, Kaspersky products also detected and blocked 27,458 bank-related phishing attacks and 91,895 of the same type targeting e-commerce shops in Malaysia.

These data are from anonymised data based on the triggering of the deterministic component in the Kaspersky’s Anti-Phishing system on user computers. The component detects all pages with phishing content that the user has tried to open by following a link in an e-mail message or on the web, as long as links to these pages are present in the Kaspersky database.

A recent study showed that seven in 10 Malaysians have tried to go cashless in 2021. The data from Bank Negara Malaysia also revealed that the average number of digital payment transactions per capital has more than quadrupled in the last ten years, increasing from 49 in 2011 to over 221 transactions per capita in 2021.

Driving cashless adoption will remain a part of an ongoing effort of the local government to bolster the domestic fintech industry.

“The first half of the year witnessed the reopening of borders in Southeast Asia but the pandemic habits seem to remain consistent. Despite our regained physical freedom, we know that we still prefer to do our banking, shopping, and financial activities online because of its unparalleled convenience,” said Yeo Siang Tiong, General Manager for Southeast Asia at Kaspersky.

A total of 7.2 billion transactions were made with electronic payment channels in Malaysia in 2021, growing 30 per cent year-on-year, making it the fastest growing year since 2006.

“Regulators and industry players in the region are all backing a digital-forward Southeast Asia and Malaysia. In fact, countries here are poised to link their QR code payment systems before the year ends to remove currency exchange hassles. It is a welcome development with possible great economic gains, for us and the cybercriminals. With most users here aware of the threats targeting our online money, it is time to act now and secure your mobile devices to enjoy the perks of a more connected, regional financial environment,” adds Yeo.

Some crucial steps to consider:

- Always keep a keen eye on suspicious emails. If it looks too good to be true, check, double-check, and triple-check.

- Maintain two email addresses if you are using free accounts. One is for official use and the other is for websites that require you to log in to read the news or gather information.

- Not all smartphones are secure so be careful of messages that will lead you to a website. There are a number of malicious software that can gain entry into your contacts list and financial apps.

- Use a reliable security solution with anti-phishing and secure payment capabilities like Kaspersky Total Security.

- Still, the best defense to phishing is being informed and discerning of the emails and other messages users receive. There is no harm in being too cautious especially most of the financial transactions are now done online in pursuit of digitalization.