Malaysia’s leading credit reporting agency, CTOS Data Systems Sdn Bhd, has rewarded consumers who checked their CTOS Score with over RM20,000 worth of gold.

The contest, “Win Gold & Hop with Joy,” was held during the Chinese New Year festive period. Eight winners with the most creative slogans from over 20,000 participants walked away with a 10-gram solid gold bar each.

CTOS Digital Berhad’s Group CEO, Erick Hamburger, said, “Advocating healthy financial habits and incentivizing people to maintain those practices is a significant role for CTOS as the country’s leading credit reporting agency.”

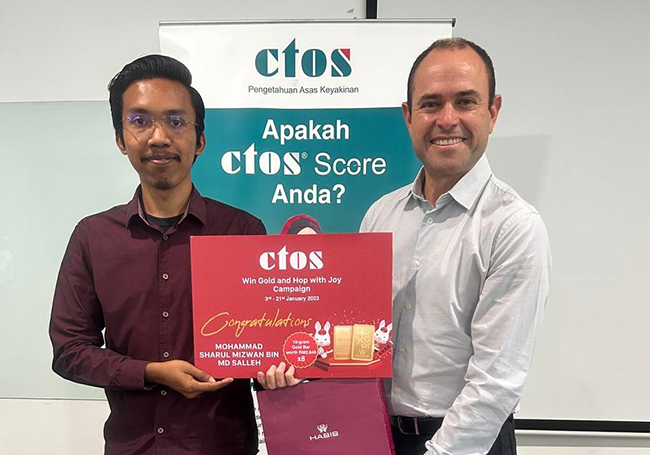

The winners received their prizes from Erick Hamburger at CTOS headquarters.

One of the contest winners, Zamir Farhan, said, “I check my CTOS Score annually even if I’m not looking for credit facilities from the banks. I always want to ensure my financial health is in good condition.”

Another winner, Vincent Loh, who works for a bank, said, “I also encourage all my colleagues to check their CTOS score periodically.”

CTOS has conducted over 450 financial education roadshows and webinars in the past six years to raise public awareness of the importance of managing credit health.

The campaign has led to a better understanding among Malaysian consumers of the value of doing self-checks to stay on top of their credit health for sound financial planning. This was evident when the recently released CTOS State of Consumers’ Credit 2022 showed a positive rise in the average CTOS Scores for Malaysians over the past three years from 663 to 678.

The CTOS Score is a 3-digit number representing a consumer’s creditworthiness based on their payment and management of credit. It ranges from 300 to 850; the higher the score, the higher the chances of securing credit.

Credit scores are essential for obtaining credit facilities such as loans, credit cards, and mortgages. Lenders and financial institutions use them to assess an individual’s ability to pay back debts and determine the interest rates and terms of the credit facilities they offer.

To learn more about credit health and sign up for the CTOS self-check service, visit https://www.ctoscredit.com.my or download the CTOS Mobile App.