Credit scores and loan approvals: What you need to know

CTOS, Malaysia’s leading credit reporting agency, has revealed key insights into how MyCTOS Scores affect loan approvals.

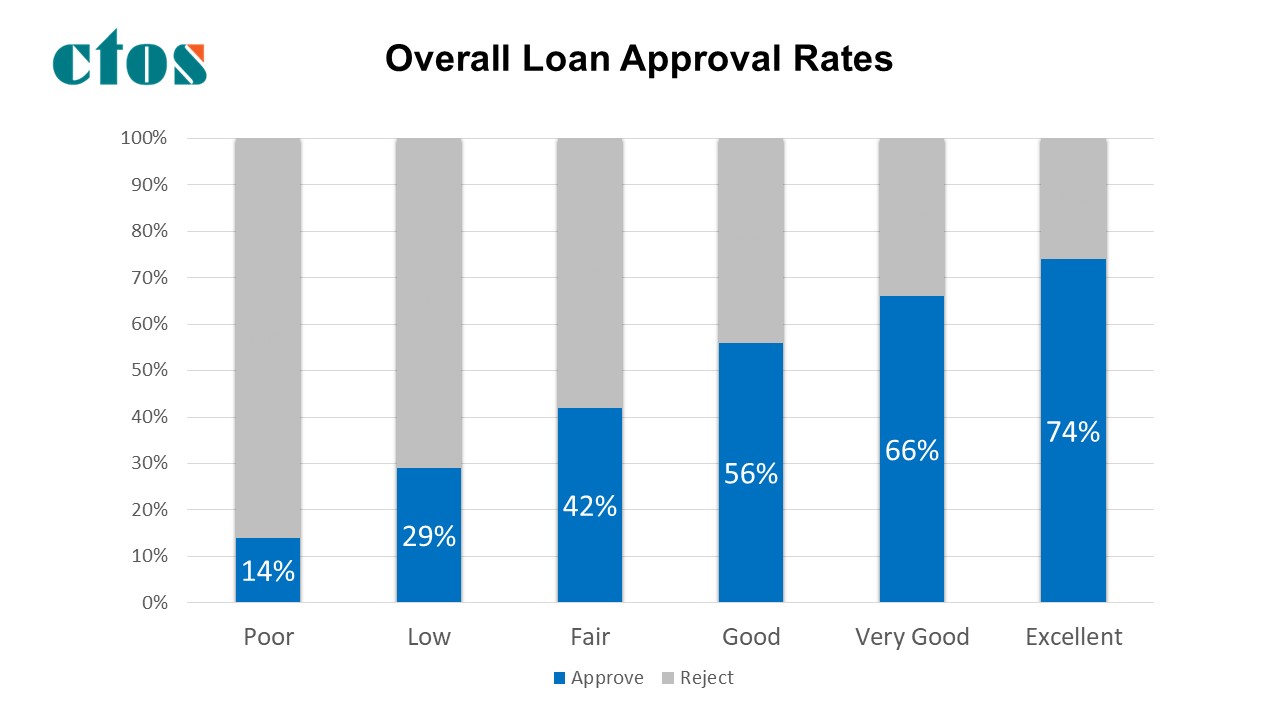

The study analysed over 250,000 credit applications, showing a clear link between CTOS credit scores and the likelihood of securing financing.

“Access to credit is essential in today’s world, allowing people to meet basic needs like housing and transportation,” said Erick Hamburger, Group CEO of CTOS Digital Berhad.

“Knowing your credit score is crucial to understanding your personal financial health.”

Consumers with an ‘excellent’ CTOS score were five times more likely to get their loan approved compared to those with lower scores.

CTOS: Loan approval disparities

The study highlighted how CTOS scores influence approval rates for various loans:

- Auto loans: 74% approval for those with excellent CTOS scores, compared to just 9% for the lowest scores.

- Home loans: 61% approval for top-tier CTOS scores, versus 22% for those with the poorest scores.

- Credit cards: Those with poor CTOS scores had a 10% approval rate, while consumers with excellent scores enjoyed a 76% approval rate.

While secured loans like auto and home financing provide some security to lenders, the results show that high CTOS scores greatly improve approval chances across all loan types.

Why credit scores matter

“Better credit scores not only improve loan approval chances, but they also lead to better interest rates and rewards,” Hamburger explained.

“Strengthening your credit score helps you access more affordable credit and makes navigating financial decisions easier.”

The MyCTOS Score Report plays a vital role in assessing an individual’s creditworthiness.

It includes the CTOS Score, CCRIS records, and other relevant data, such as bankruptcy information, litigation, and business interests.

All of this information helps financial institutions make informed lending decisions.

How CTOS Scores are calculated

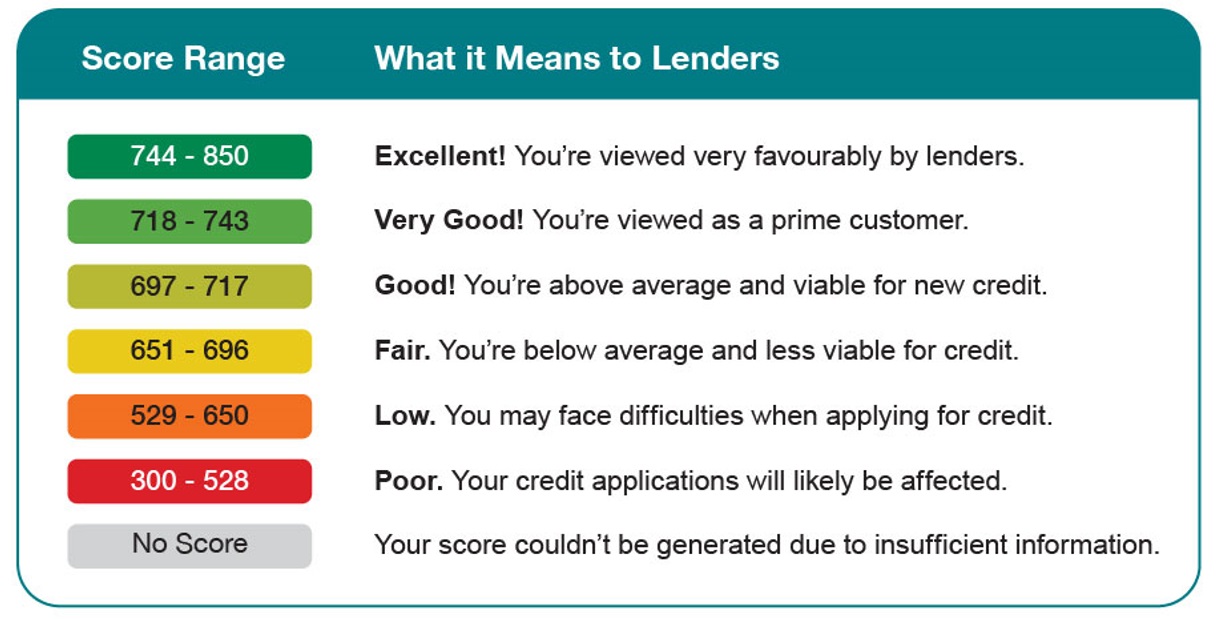

The CTOS score is a 3-digit number ranging from 300 to 850, determined by five key factors:

- Payment history

- Amount owed

- Length of credit history

- Credit mix

- New credit applications

These factors give lenders a clear picture of an individual’s credit health, with higher scores representing better creditworthiness.

To check your MyCTOS Score, visit the official website at www.ctoscredit.com.my.

CTOS isn’t involved in lending decisions, but the information they provide helps financial institutions assess applicants’ creditworthiness.

If you’re looking to improve your financial standing, managing your credit score should be a top priority.

The MyCTOS Score Report offers invaluable insights, giving consumers the tools to better manage their credit and increase their chances of loan approval.