Tune Protect Malaysia, the General Insurance subsidiary of Tune Protect Group Berhad, has become the first insurance company in Malaysia to leverage SAP insurance core and core on the cloud.

This implementation marks a significant milestone in Tune Protect’s digital transformation journey and aims to enhance the overall customer experience.

By partnering with SAP Malaysia, Serole Technologies, and Huawei Malaysia, Tune Protect has successfully launched a new core system that utilizes cloud technology for faster and more efficient services.

Technology innovation for customer empowerment

Tune Protect Malaysia takes pride in its continuous pursuit of technology innovation to empower its customers. By adopting SAP Insurance core and core on the cloud, the company has demonstrated its commitment to delivering exceptional digital insurance services.

Jubin Mehta, the CEO of Tune Protect Malaysia, expressed his enthusiasm, stating that the newly implemented insurance solution represents a major breakthrough for the company. With this advanced technology, Tune Protect can swiftly introduce new products and services, thereby providing customers with an enhanced experience.

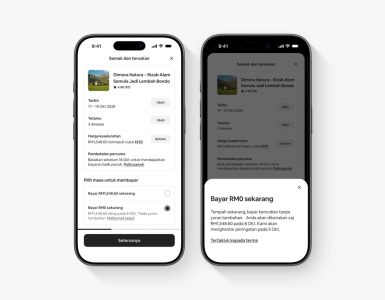

The core system’s primary objective is to streamline policy processing and claims cycles by simplifying workflows and introducing automation. This strategic move aligns with Tune Protect’s customer commitment of 3:3:3, ensuring quick insurance purchases, responses, and claim payments.

By embracing digital insurance capabilities and offering innovative products, Tune Protect aims to provide a seamless and efficient customer experience. Moreover, the implementation of the core system reduces time-to-market, enabling Tune Protect to outpace competitors and meet evolving customer demands in a highly competitive industry.

Cloud-based core system driving transformation of Tune Protect

The deployment of the central system on the cloud brings several benefits to Tune Protect. By eliminating operational complications and physical infrastructure setup, the internal technology team can focus on delivering greater business value.

Prasanta Roy, the Chief Technology Officer of Tune Protect, emphasized the positive impact of the new SAP-based core system on data management. The system enables a comprehensive transformation from the front end to the back end, facilitating a cohesive customer experience across a wide range of products and services.

The newly implemented core system consists of various modules, including policy, claims, product and quote, reinsurance management, and finance operations. These modules contribute to streamlining workflows and signify a significant advancement in Tune Protect’s ongoing digital transformation journey.

With improved efficiency and enhanced customer service, Tune Protect can meet customer expectations effectively. The core system’s flexibility also allows for the introduction of fresh offerings, leading to value creation and ensuring Tune Protect remains at the forefront of the industry.

Tune Protect is well-equipped to deliver enhanced insurance services, providing customers with a seamless and efficient experience through the new core system. The streamlined processes, automation, and improved digital capabilities contribute to Tune Protect’s competitive advantage in the dynamic insurance market.