The 2023 RinggitPlus Malaysian Financial Literacy Survey (RMFLS) has shed light on the ongoing financial challenges faced by Malaysians, revealing that a significant portion of the population believes their financial situation has deteriorated compared to the previous year.

The survey, which provides insights into the financial behaviors of Malaysians, paints a concerning picture of financial struggles and worries among respondents.

Financial Hardships Persist

According to the RMFLS, a striking 32% of respondents believe that their financial situation in 2023 is worse than it was in 2022.

This widespread pessimism is accompanied by emotional distress, as more than half (55%) of those surveyed admitted to feeling anxious, frustrated, or embarrassed about their current financial circumstances.

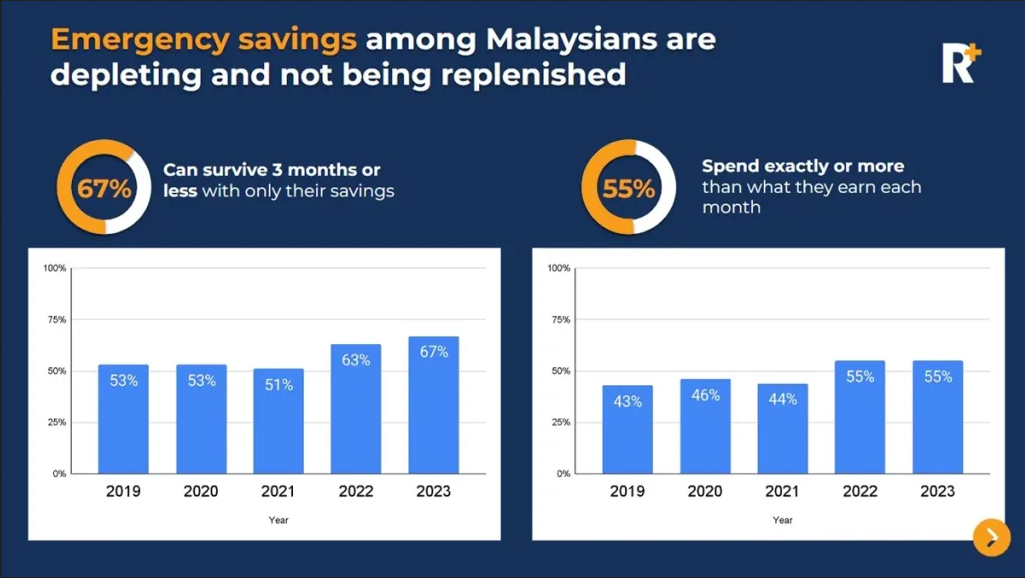

The survey highlighted the challenging financial landscape for many Malaysians. An overwhelming 71% of respondents reported saving less than RM500 per month, and 67% revealed that their emergency savings could sustain them for three months or less.

Additionally, a significant 55% of respondents confessed to spending as much as or more than they earn each month, effectively living from one paycheck to the next.

Unexpected resilience

However, there is an unexpected silver lining in the midst of these financial difficulties. Despite the global economic uncertainties, Malaysians appear to be demonstrating surprising resilience by taking proactive measures to improve their financial situations.

An impressive 94% of respondents indicated that they had made efforts to enhance their financial well-being in 2023.

“The RMFLS findings this year highlight the new challenges that Malaysians face, and serve as a reminder that they can only be overcome through collaborative efforts from all parties across the government, the financial services industry, and the rakyat.

I am inspired by the resilience demonstrated by Malaysians in addressing financial adversities, and we at RinggitPlus will continue to play an active role in improving digital financial literacy in Malaysia,” said Yuen Tuck Siew, CEO of RinggitPlus.

The top three actions taken by respondents to improve their financial situation included cutting back on leisure activities, reducing dining out, and diligently tracking their expenses.

Initiatives within the Madani Economy Framework and the recently announced Budget 2024 are set to play a pivotal role in reducing the financial disparities between Malaysian men and women.

Budget 2024 includes specific financing support for female entrepreneurs and tax incentives designed to encourage women to re-enter the workforce, all contributing to the broader goal of increasing female participation in the labor force.

As part of the RMFLS 2023 initiative, RinggitPlus is collaborating with partners GXBank, CTOS, and Capital Dynamics to produce a series of social-first educational content focused on various aspects of personal finance.

For further information on the 2023 RinggitPlus Malaysian Financial Literacy Survey, please visit RinggitPlus’ social media channels on Instagram, Facebook, and TikTok.